As you can see the market is somewhat emotional and driven by news. From the perspective of the Technical Analysis, two buy signals in 0.0.3 SPY Mid-term Trading Signals are still valid, so I assume the trend is up over the intermediate term. In the near term, the market may likely rally tomorrow.

0.0.2 SPY Short-term Trading Signals. Here is the evidence for tomorrow's rally. NYAD indicates that there are more Advancing issues today compare with yesterday, which is a positive divergence. RHNYA at the bottom of the chart is oversold, which also support the rebound of the market. In addition, VIX is overbought which is also bullish to the market.

1.1.5 PowerShares QQQ Trust (QQQQ 15 min), Bullish Falling Wedge, MACD, RSI positive divergence.

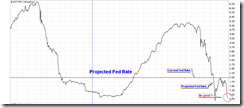

3.0.1 Yield Curve. Today UST3M went down again, which means the short of fund. This is bearish.

6 Comments