Today is very bad. I expected a pullback but eventually it turned out to be a crash, and in fact it is the second biggest down day after Oct 15th 2008. To make it even worse, 2.4.2 NYSE - Issues Advancing which is quite accurate is still overbought, and this means there is hopeless to see a rally in the short term. I looked through my whole chart book and cannot find a single signal which makes bulls potentially relieved.

1.0.3 S&P 500 SPDRs (SPY 60 min). The last hope of bulls is the gap support at the bottom. However I don't know if it will hold.

1.0.4 S&P 500 SPDRs (SPY 15 min). RSI is extremely oversold, so the market may bounce back up in the early morning. However, remember that after the same magnitude of RSI oversold, the market didn't rally after Nov 6th and kept dropping until close. Today's scenario is very similar with Nov 5th.

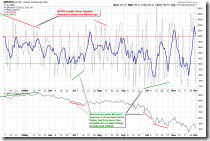

2.4.2 NYSE - Issues Advancing, still overbought.

3.0.3 20 Year Treasury Bond Fund iShares (TLT Daily). The bond is flying to the sky. Once again, it approves that when the bond market doesn't agree with the stock market, the former is more convincible. You will know more after reading 3.0.5 SPY and TLT.