OK, I was wrong yesterday. The 2nd time I used "Rebound" as title and the 2nd time the market replied with big sell off the 2nd day (The first time was June 10, 2008, but at that time, this blog wasn't opened yet. I have far longer history of writing daily report than this blog, by the way). As yesterday's commentary area says, I was particularly worried about using "Rebound" as a title because I was afraid that the same thing would happen again. Well anyway, good indicator it seems, whenever I use "Rebound", short right away. The good news is that the market did rebound on the 3rd day, so let's see if the same thing could happen again. According to today's TICK readings, yes, tomorrow might be a reversal day. The worst case is big sell off again tomorrow, Friday up. Well, it's just a guess, don't bottom fish accordingly. I'll review some of reliable bottom fish signals in today's report. Again it's very dangerous to bottom fish even with these signals support, so be careful.

7.0.3 NYSE Composite Index Breadth Watch, my "equal up down strength" rule, 8 days up trend vs 6 days down trend, apparently bears won. Now the intermediate-term top signals I mentioned on 01/07/2009 Market Recap: Intermediate-term Top?, should finally be confirmed.

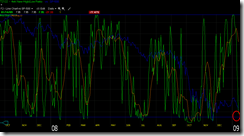

0.0.2 SPY Short-term Trading Signals, pay attention to dashed vertical green lines, with TICK close bellow -1000, big sell off the 2nd day but good chances an intra-day reversal. The worst case was Nov 19, big sell off on Nov 20, sharp up before close on Nov 21. By the way, Nov 20 was Thursday and Nov 21 was Friday. So if history repeats itself, I tend to guess that we're repeating Nov 20 and 21. If so, because this time the drop is too steep, good chances that the big sell off might end Friday and we're going to see a very good rebound which might last until Feb. Well, it's just a GUESS, we'll see.

1.3.7 Russell 3000 Dominant Price-Volume Relationships, 1657 stocks price down volume up which means that the market is oversold. I would not read too much into it however.

OK, let's review some of my bottom fish signals:

2.4.2 NYSE - Issues Advancing, not yet. Even it's oversold, the worst case it can remain oversold for up to 3 days.

T2122 from Telechart, NYSE 4 week New High/Low Ratio, not yet, again even it's oversold, it can remain oversold for a few days.

SPX Climactic Volume Indicator from www.decisionpoint.com, not yet.

TICK in chart 1.0.3 S&P 500 SPDRs (SPY 30 min). For easy comparison, I put a big chart here, again, not yet.

1 Comment