| Trend | Momentum | Comments - Sample for using the trend table. Warning: This is NOT a trading recommendation! | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Neutral* | Hold long. |

| Short-term | Down | Neutral |

| Report Focused On | Buyable dip or the market topped? |

| Today’s Summary | No clue, hope tomorrow the market could give us more hint. |

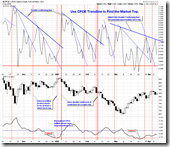

The double confirming line on 2.8.0 CBOE Options Equity Put/Call Ratio has not broken yet, which is what I expected. As I mentioned in the yesterday report, the market would seesaw and top out after several rounds of N vs N while the institutional accumulation is greater than distribution. Concerning the N vs N rule, if the market pulls back and 780 still holds, then 4 up days vs 4 down days thus bulls win, and that will be a buyable dip (no guarantee that the market won’t pullback further on the next Monday). If the market rises tomorrow and the low is above SPX 814, 2 down days vs 2 up days, bulls will be losers if the day high is below 845, then the dip is not a buy and one should wait until Monday. Ironically, bulls wish a down day while bears are looking forward to the opposite.

1.0.4 S&P 500 SPDRs (SPY 15 min). Bullish falling wedge plus pre-holiday effect, the market would possibly rise, however I am not completely sure.

1.1.4 Nasdaq 100 Index Intermediate-term Trading Signals. It’s still overbought.

1.3.7 Russell 3000 Dominant Price-Volume Relationships. 1571 stocks price up volume down, bearish. However I am not sure if this data can be ignored because of the pre-holiday effect.

20 Comments