| Trend | Momentum | Comments - Sample for using the trend table. Warning: This is NOT a trading recommendation! | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

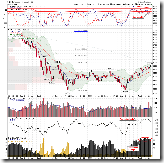

| Intermediate | Up | Overbought | According to $NYA50R and $CPCE, market might be topped. |

| Short-term | Up | Neutral |

| Report Focused On | Buyable dip or the market topped? |

| Today’s Summary |

1 vs 3 bear won, however break above SPX 875 any time then uptrend is still intact. Expect QQQQ to pullback soon. |

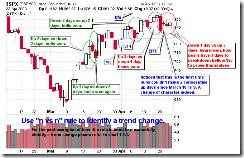

7.1.0 Use n vs n Rule to Identify a Trend Change, 1 vs 3 bears won, so still the same predication about the market: seesaw while keep having lower low. However, the predication will be invalid any time if SPX breaks above 875.

Not much other to say today. Bearish signals have a little edge, not very much though, so market has slightly better chance to close in red tomorrow.

1.0.4 S&P 500 SPDRs (SPY 15 min), any gap up open tomorrow will likely be filled because ChiOsc is already high so an up gap will make it go extreme.

1.1.4 Nasdaq 100 Index Intermediate-term Trading Signals, still overbought. (StockCharts.com has a data error about NDXA50R at bottom, but anyway, I can guarantee you it’s still very high today.)

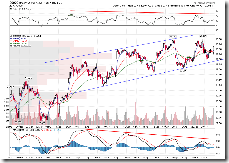

1.1.5 PowerShares QQQ Trust (QQQQ 30 min), too big the negative divergences, expect a big pullback soon.

3.1.1 PowerShares DB US Dollar Index Bullish Fund (UUP 30 min), RSI oversold seems pretty accurate recently, therefore US$ might rebound tomorrow, this is not good for commodities and so is bad for the overall market.

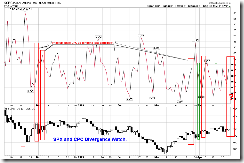

7.0.2 SPX and CPC Divergence Watch, when both price and CPC rise together, most likely an unpleasant day next day. If however the market manages to close in green tomorrow then pay attention to CPC. If it rises as well then very unpleasant next Monday may be.

7.3.2 Firework Trading Setup, forgot to mention this yesterday, a firework trading setup was triggered because CPC was less than 0.8 yesterday.

20 Comments