Summary:

Could be more rebound tomorrow.

Bulls better break above 932 tomorrow to prove themselves.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | |

| Short-term | Down | Neutral |

I see reversal bars everywhere so the market may continue to rebound tomorrow. As mentioned in the After Bell Quick Summary, when both VIX and SPX were up on the same day, 7 out of 8 times recently the next day closed in red, so my best guess is that tomorrow we could see an intraday rebound in the morning then eventually closes in red. Anyway, no matter what happens tomorrow, according to 7.1.0 Use n vs n Rule to Identify a Trend Change, if SPX couldn’t high above 932 then most likely it’s a sell-able bounce.

Just have a quick look at so called “Reversal Bars Everywhere”:

0.0.2 SPY Short-term Trading Signals.

2.0.0 Volatility Index (Daily), VIX might drop which is good for the SPX to rebound.

3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), US$ may drop which is good for the SPX to rebound.

3.4.2 United States Oil Fund, LP (USO 30 min), very oversold plus positive divergence, oil could rebound which is good for the SPX to rebound.

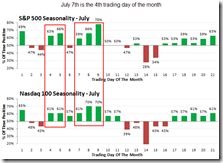

Also it seems that the following several days are bullish from seasonality point of view.

3 Comments