Summary:

Simple list of some short-term "bear friendly" signals.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Overbought | |

| Short-term | Up | Neutral |

Nothing new to say, most agree that big picture is up, just have different view on when short-term will pullback or even if there’s ever going to be any meaningful pullback. Short-term, I have one more reliable overbought signal triggered today, T2112 % of stocks trading 2 std dev above MA40 from Telechart, hitting a new record high. The last time, it was this high a little bigger pullback happened, see blue curve marked by a red cycle. Also now SPY has 9 unfilled gaps, so I still expect a short-term pullback soon. Just as the After Bell Quick Summary mentioned, because CPC < 0.8, so 77% chances a green close tomorrow, this means that the pullback may not happen tomorrow.

Simply listed below other “Bear Friendly” signals for your references:

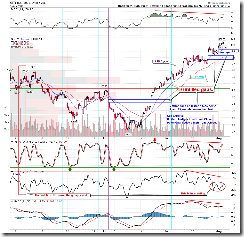

1.0.2 S&P 500 SPDRs (SPY 60 min), 9 unfilled gaps plus lots of negative divergences. The most notable part is that ChiOsc was negative all day which means that volume didn’t confirm today’s rally.

Speaking of volume, take a look at the daily chart, 0.0.2 SPY Short-term Trading Signals, up 3 days in a row, but volume down 3 days in a row, this is a so called price-volume negative divergence which in the PAST often led to a pullback. Anyway, pay attention to the volume, if we have yet another up day tomorrow.

T2103 Zweig Breadth Thrust from Telechart, overbought.

T2122 4 Week New High/Low Ratio from Telechart, overbought. Well it still has a little bit up room though.

20 Comments