Summary:

Some observations about post Major Accumulation Day.

Expect a pullback next Monday at least in the morning.

A few interesting charts.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Down | Neutral | Intermediate sell signals still need further confirmation. |

| Short-term | Up | Neutral | |

| My Emotion | Up* |

Common believes are that the last C up leg has started. Some expect it to go much much higher and some say it’ll be short lived. I couldn’t see that far, just since the Friday was a Major Accumulation Day (90% up day), so we can gather some clues from the past about what had happened after a Major Accumulation Day.

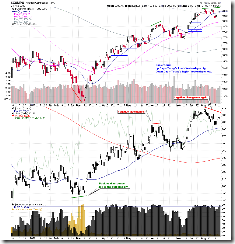

7.0.A Major Accumulation Day Watch.

- See blue thick lines, if 2 Major Accumulation Days happened within 5 days, then it signals a tradable bottom. So within a very short time, if we have the 2nd Major Accumulation Day, then odds are very high that the market will go much much higher.

- From dashed red lines, the next day if closed in red, usually was shallow. The key to watch is the next next day, if still closed in red, then odds are high that this is a tradable top.

Well, I think the above 2 tips should enough to guide the recent trade. If you really really are afraid of missing this train to north, you could long any time, just do not average down if the market dropped. Simply wait for your position to be out of water because according to the recent experiences, no matter when to long, the only thing needed was patience, pretty soon the position would be out of water. So if this time (or any time thereafter) is different then something must have changed, in this case no average down strategy will at least make you loss less.

Some charts below arguing for a short-term pullback.

The Friday’s After Bell Quick Summary mentioned that CPC and CPCE were way too low and the last time CPCE was this low was 01/24/2006. The following chart is a longer history normalized CPC. It looks like a short-term top, at least very close.

1.0.4 S&P 500 SPDRs (SPY 15 min), lots of negative divergences, so could be a pullback at least Monday morning.

2.0.0 Volatility Index (Daily), 3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), red hollow bar usually leads to a reversal. The rebound of VIX and/or UUP (if they do on Monday) usually means a pullback of the stock market.

T2103 Zweig Breadth Thrust from Telechart, overbought.

The following charts are for your info only.

Rydex Bull/Bear RSI Spread, Rydex bears are vey active therefore this chart looks like we’re at a market bottom now. (yes, it’s “bottom”, not a typo.)

0.0.1 Market Top/Bottom Watch, a reader commented that according to this chart, the top is very close. Personally, I trust only NYDNV. I’m not sure about the other 2 conditions whether they are extreme enough.

1.1.0 Nasdaq Composite (Daily), the divergence between COMPQ and SOX worked very well in the past for catching the market top/bottom. Now a negative divergence was formed which could mean a top is in the forming. Well, divergence can only be treated as a warning, it’s by no means a signal to act upon.

5.0.5 S&P Sector Bullish Percent Index I (Weekly), 5.0.6 S&P Sector Bullish Percent Index II (Weekly), lots of “very overbought”. For your conveniences I put all the “overbought” together on the same chart.

19 Comments