The bottom line, the VIX ENV/BB buy setup and the Reversal Bar buy setup were triggered today which mean short-term up. But for the intermediate-term, I see no evidence that the trend has been changed yet, so still maintain the down predication.

I see 2 tricks today. One points to a red day tomorrow and the other a green day tomorrow.

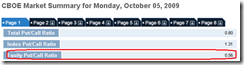

CPCE <= 0.56, 19 out of 27 cases (70%) a red day the next day.

When ISEE Indices & ETFs Only Index < 50 and ISEE Equities Only Index > 160, 8 out of 13 cases (62%) a green day the next day.

According to the past few cases when these 2 tricks conflicted, it seems that CPCE has a higher priority therefore a red day tomorrow is a little bit more likely.