Summary:

One more good news for bulls: US$ could pullback. If all those bullish signals still could not make the market rally huge then the primary wave 3 down could have started.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Down | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | Short if 11/02 low is taken. | Officially in downtrend. | ||

| Reversal Bar | ||||

| NYMO Sell | 10/21 S | *Adjust Stop Loss | *10/30 High |

|

| VIX ENV | ||||

INTERMEDIATE-TERM: US$ COULD PULLBACK

The rebound today was weaker than I expected, could be related to the Fed day tomorrow, so let’s see tomorrow. As mentioned in yesterday’s Market Recap, the bear’s only hope is 6.3.2b Major Distribution Day Watch, there could be a 3rd Major Distribution Day. Except for that reason, so far all the other signals are “bull friendly”:

- 1.0.7 SPX Cycle Watch (Daily), could be a cycle bottom.

- 1.1.4 Nasdaq 100 Index Intermediate-term Trading Signals, lots of bottom signals.

- 2.0.0 Volatility Index (Daily), completely out of BB bar means a bottom.

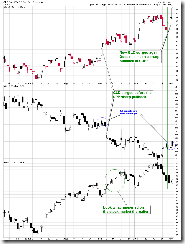

Today, bulls got yet another good news: 3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), black bar usually means a reversal, so US$ could pullback.

3.3.0 streetTRACKS Gold Trust Shares (GLD Daily), noticed that gold surged today. Not sure if it means Fed will signal more money printing tomorrow. Just take a look at the chart below, the gold price surge could lead to a sharp pullback of the US$ which means higher stock and commodity price.

3.4.2 United States Oil Fund, LP (USO 30 min), the USO looks bullish too. This, from the other angle, also implies that the Fed announcement tomorrow will do no good to US$.

So to summarize, although I FEEL that on the intermediate-term there should be more pullbacks, just I could barely find any reasons in my chart book supporting more pullbacks ahead. In another word, if even in this situation, the market still couldn’t rally huge, then indeed the wave 3 down has started. Let's wait and see.

SHORT-TERM: NO UPDATE

INTERESTING CHARTS: NONE