Summary:

Could be bigger and bigger up and down swings ahead, I consider them as part of a slow topping process.

Expect a short-term pullback as early as tomorrow.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | Officially in downtrend. | |||

| Reversal Bar | ||||

| NYMO Sell |

Stopped out with gains on 11/05. |

|||

| VIX ENV | ||||

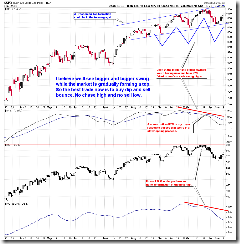

INTERMEDIATE-TERM: COULD BE BIGGER AND BIGGER UP AND DOWN SWINGS AHEAD

The recent market actions remind me of the July 2007. The market at that time had the same bigger and bigger up and down swings with NYSI not confirming each swing tops and Russell 2000 underperforming. See charts below. So now I’m more willing to believe that the market is in a slow topping process and there’ll be bigger and bigger up and down swings ahead. As for how many swings we will see and how long this topping process will last, I have no idea. Just for trading, better buy dip and sell bounce, instead of chasing high and selling low. In another word, for today, if you’ve missed the 6 days rally, better wait for a dip and do not short before seeing a bearish reversal day.

Well, is it possible that now is actually a bottom, market from now on will go much much higher? 6.3.1 Major Accumulation Day Watch, today is a Major Accumulation Day, if within 5 days, there’s another Major Accumulation Day, plus the NYMO positive divergence we have now, the chance will be very good that the market will go much much higher. Until then, I’ll maintain my view for calling a slow topping process, in which the market will have bigger and bigger up and down swings.

7.1.0 Use n vs n Rule to Identify a Trend Change, because some readers still ask about it, so I mention it here: 6 vs 6, still bear won, therefore by definition, this still is a sellable bounce. Just I have no confidence about this rule anymore because it didn’t work well so far this year.

SHORT-TERM: EXPECT A PULLBACK AS EARLY AS TOMORROW

In today’s After Bell Quick Summary, according to the 10 day up cycle and ISEE Equities Only Index readings, I think there might be one more push up. However before this one more push up, it’s very likely we’ll see a pullback first. Two reasons:

SPY up 6 days in a row, sell the next day open then cover at the next next day close. See chart below for the statistics. The entry date: 3/20/2003, 9/3/2003, 12/2/2003, 4/1/2004, 5/28/2004, 12/16/2004, 7/15/2005, 11/25/2005, 1/11/2006, 10/26/2006, 11/20/2006, 2/7/2007, 4/9/2007, 5/20/2008, 7/24/2008, 10/13/2009. (Red highlighted are failed trades) Also, the price up volume down setup mentioned in the Friday’s report is still valid.

6.4.5 GLD and UUP Watch, GLD black bar usually means a rebound of US$ so market may pullback tomorrow.

INTERESTING CHARTS: NONE