Summary:

The rebound since 11/02 was not broad based.

SPY up 7 days in a row was mostly a short-term top in the past.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | *Short if Open > Close tomorrow. | Officially in downtrend. | ||

| Reversal Bar | *Short if Open > Close tomorrow. | |||

| NYMO Sell |

Stopped out with gains on 11/05. |

|||

| VIX ENV | ||||

INTERMEDIATE-TERM: NOT A BROAD BASED RALLY

1.2.3 Value Line Arithmetic Index (Daily), watch the green cycles. The previous 2 rallies were consist of white bars ONLY but this time bar colors are mixed, apparently the rally since 11/02 was weaker. So as mentioned in yesterday’s report, it looks a lot like what happened in July 2007 when NYSI didn’t confirm the market new high, therefore I believe the market is forming a Broadening Top where we’ll see bigger and bigger up and down swings.

0.0.3 SPX Intermediate-term Trading Signals, although according to my experiences, the similarity usually doesn’t work, but still I have to report what I see here: If the SPX repeats the previous blue cycle, then we should see another big push up tomorrow.

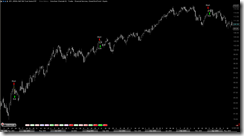

SHORT-TERM: SPY UP 7 DAYS IN A ROW WAS MOSTLY A SHORT-TERM TOP IN THE PAST

SPY had its 7th consecutive winning streak today, see back test results below – sell at next day open, cover at the next next day close. In addition, from the visual back test charts, it seems that SPY up 7 days in a row is more likely a short-term top. Also if tomorrow, SPY opens high then closes lower, two setups listed in the trend table above will be triggered. Both of these 2 setups have above 60% winning rate, plus the statistics about the SPY up 7 days in a row, the odds of winning seem good, therefore I might follow these 2 setups.

Back Test Summary:

Trades:

Visual Back Test:

INTERESTING CHARTS: NONE