Summary:

Secondary indices are strengthening so not sure about intermediate-term top anymore. However still expects a short-term top.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model |

|

*Stopped out of long position with gain.

|

||

| Reversal Bar | 11/30 L |

|

Breakeven |

|

| NYMO Sell | 12/04 S | *Short intraday | 0.8xATR(10) |

Use 2% for SPY. |

| VIX ENV | ||||

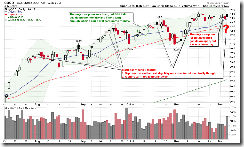

INTERMEDIATE-TERM: MIXED SIGNALS

7.1.1 Primary and Secondary Indices Divergence Watch, SOX, TRAN and Russell 2000 all outperformed, so the reasons for calling an intermediate-term top is greatly reduced. Remain in wait and see mode now.

7.1.2 NYSE Advance-Decline Issues, also because of the Russell 2000 outperforms, the NYAD negative divergence is fixed. This is a very important improvement.

Of course, there’re still lots of warnings. Besides the 7.1.2 chart above, Investor's Intelligence Sentiment Survey has too few bears and COT Report shows that smart money is bearish. Just, since they’re warnings only, so it may take awhile before the market actually tops.

I’ll watch the dollar closely the next week. If the Friday’s UUP volume surge is not an one day event, then it will be no good for bulls. We'll see, especially pay attention to FXE (EURO) support underneath.

SHORT-TERM: VERY CLOSE TO A TOP

Maintain forecast for “very close to a top”. Three reasons below, they’re all very accurate charts.

Reversal day worked very well since March.

0.0.4 Extreme Put Call Ratio Watch, CPC and CPCI too low usually mean a top.

1.1.3 QQQQ Short-term Trading Signals, black bar again.

INTERESTING CHARTS: NONE