Summary:

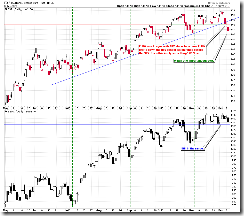

Market is till range bounded.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | *Down | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model |

|

|

||

| Reversal Bar |

|

*Stopped out of long position flat.

|

||

| NYMO Sell | 12/04 S | *Adjust Stop Loss | *Breakeven |

|

| VIX ENV | ||||

INTERMEDIATE-TERM: MIXED SIGNALS

In wait and see mode. See 12/04/2009 Market Recap for more details.

Still want your attention to FXE. EURO broke down below range first, will SPX follow? Let’s wait and see.

SHORT-TERM: MIXED SIGNALS

As mentioned in the After Bell Quick Summary, the market is still range bounded, so the direction is unclear, need see tomorrow.

In yesterday’s Market Recap, I said two cycles are due today, but unfortunately, one is calling for a bottom and the other calling for a top, so again no direction, need see tomorrow.

1.0.7 SPX Cycle Watch (Daily), looks like a cycle top.

1.0.9 SPX Cycle Watch (60 min), looks like a cycle bottom. However the 60 min cycle only applies for couple of days and is not as reliable as the daily cycle mentioned above.

Personally, I’ll pay close attention to Rydex Fund traders actions. The most update data is available tomorrow morning on www.sentimentrader.com, so the chart below shows only the yesterday’s data. So far the retailers were bullish. If the most updated spread keeps increasing then chances are high that the pullback is not over yet. I’ll keep you informed.

INTERESTING CHARTS: NONE