Summary:

A little bearish biased because it seems that COMPQ black bar usually led to a short-term top.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | *Up | Neutral | *Need further confirm. | |

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 12/10 L |

*Long intraday. |

12/09 Low |

*No confidence in this trade.

|

| Reversal Bar | 12/10 L |

*Long intraday. |

12/09 Low |

*No confidence in this trade.

|

| NYMO Sell | 12/04 S | Breakeven |

|

|

| VIX ENV | ||||

INTERMEDIATE-TERM: MIXED SIGNALS

In wait and see mode. For more details please see 12/04/2009 Market Recap.

SHORT-TERM: A LITTLE BIT BEARISH BIASED

Not much to say and no idea about tomorrow. Short-term, a little bit bearish biased though, reasons below:

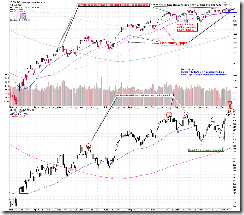

1.1.0 Nasdaq Composite (Daily), looks like black bar always led to a short-term top, besides it has too many unfilled gaps.

Let’s take a look at AAPL (Really have nothing else to say, so…), as it weights above 10% in QQQQ, so perhaps it’s the most important stock in the market. It formed a bearish reversal bar today and looks a lot like a back test to the broken trend line.

INTERESTING CHARTS:

3.4.1 United States Oil Fund, LP (USO Daily), ChiOsc is way too low so oil could rebound soon, this is good for the stock market.