Summary:

Despite very bullish seasonality, the market may not be able to go up much because there're too few bears.

Could be more pullback ahead.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | *Down | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 12/10 L |

|

*Stopped out of long position flat on 12/17 | |

| Reversal Bar | 12/10 L |

|

*Stopped out of long position flat on 12/17

|

|

| NYMO Sell |

|

|||

| VIX ENV | ||||

INTERMEDIATE-TERM: BULLISH SEASONALITY BUT MARKET MAY NOT UP HUGE

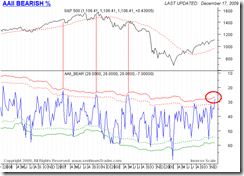

Nothing new, see 12/14/2009 Market Recap and 12/16/2009 Market Recap for more details. Seasonality is very bullish but there’re simply too few bears left, so I suspect how high the market could go. Today’s AAII survey shows again too few bears. It doesn’t mean a top but certainly it agrees that there’s not much upside room left.

SHORT-TERM: COULD BE MORE PULLBACK AHEAD

The QQQQ black bar mentioned in yesterday’s report is confirmed today. Take a look at the chart below, what happened in the past when a black bar was confirmed by a big red bar?

INTERESTING CHARTS:

1.4.0 Shanghai Stock Exchange Composite Index (Daily), the rule is simple, whenever there’s a big (I mean really big) red bar, there’d be more pullbacks ahead.