Summary:

More evidences point to a short-term top coming.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Up | Neutral |

II Survey: Historical low number of bears. |

|

| Short-term | Up | Neutral |

0.0.9 CPC/CPCI: Topped? |

|

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals, details are HERE. Take profit whenever you see appropriate. |

| ST Model | 12/21 L |

|

Breakeven | |

| Reversal Bar | 12/21 L |

*Adjust Stop Loss |

12/24 Low |

|

| NYMO Sell |

|

|||

| VIX ENV | ||||

| Other Signals | 12/28 S | 2xATR(10) |

2% stop for SPY, 4% for 2xETF. |

INTERMEDIATE-TERM: BREAKOUT BUT I'M NOT CONVINCED

Nothing new, breakout but I'm not convinced, see 12/24/2009 Market Recap for more details.

SHORT-TERM: COULD BE A PULLBACK SOON

Nothing new too, still looking forward to a short-term pullback. Two more evidences:

1. SPY Bearish Reversal Day, take a look at what happened thereafter.

2. 1.0.9 SPX Cycle Watch (60 min), looks like a cycle top.

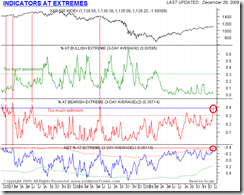

The most recent Indicators At Extremes from www.sentimentrader.com, number of indicators at bearish extremes are still very high.

The bottom line, no doubt this is an uptrend and the Santa Rally is supposed to end on 1/5/2010, so, sure, bear can bet its luck here, just be cautious, try best not to lose another CLAW AGAIN. LOL

INTERESTING CHARTS: NONE