|

||||||||||||||||||||

|

||||||||||||||||||||

|

||||||||||||||||||||

|

INTERMEDIATE-TERM: EXPECT HEADWIND AHEAD

No update, watch 4.1.0 S&P 500 Large Cap Index (Weekly) for overhead target/resistance and 4.0.4 Dow Theory: Averages Must Confirm for overbought breadth signals.

SHORT-TERM: NATV TO NYTV RATIO ROSE EVEN HIGHER

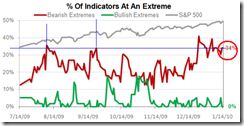

The same old problem, CPC and CPCE are extremely low (see table above) and www.sentimentrader.com has too many indicators at bearish extremes. So still think it’s better to reduce long position.

2.3.4 Nasdaq Total Volume/NYSE Total Volume, moved even higher which means people are crazy about high beta stocks. This usually is a sign of extreme bullishness therefore could mean a top. Also Rydex traders seem to extremely like Nasdaq too. Anyway, I’m not calling a top, I just mean better be safe then sorry.

The most recent II and AAII Bull Ratio, also at extreme level.

INTERESTING CHARTS:

Take a look if interested, I don’t know if 251 / 346 = 73% outflow was block sell today means IWM bearish tomorrow or not?

1.0.8 SPX Cycle Watch (Moon Phases), if you believe look at the moon is not superstitious then click the link see for yourself.