|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: WEEK AFTER TRIPLE WITCHING, DOW DOWN 15 OF LAST 22, ALSO MARCH IS KNOWN AS A TURNING MONTH

Interestingly, tomorrow is the most likely red day in March. Others see 03/19 Market Recap for more details.

CYCLE ANALYSIS: COULD RISE TO AROUND 03/25 BEFORE ANY MEANINGFUL PULLBACK

See 03/22 Market Recap for more details.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD

See 03/19 Market Recap for more details.

SHORT-TERM: MORE TOP SIGNALS, BUT BEARISH ENGULFING TODAY MAY MEAN A HUGE REBOUND TOMORROW

Today is a Bearish Reversal Day (Opened high but closed in red) and it’s the 4th reversal day since the March rally therefore the chances should be good for a follow-through to a downside within very short-term. However, take a look at the chart below, despite statistics say that Bearish Engulfing means bearish reversal 79% of the time, but it looks like the next day after a Bearish Engulfing is always up huge, no matter whether this is the 2nd or the 3rd or the 4th etc etc Bearish Engulfing day. So bears, be prepared to be shocked again tomorrow.

As mentioned in today’s After Bell Quick Summary, the ChiOsc in chart 1.0.3 S&P 500 SPDRs (SPY 30 min) is way too low arguing for a rebound at least tomorrow morning. Take a look at 1.1.5 PowerShares QQQ Trust (QQQQ 30 min) and 1.3.2 Russell 2000 iShares (IWM 30 min), their ChiOsc are also too low.

So to summarize above, there’s a good chance we’ll see a rebound tomorrow, I’m not very sure though after all seasonality says a red day tomorrow. Anyway, the bottom line is on a little bit longer term than tomorrow, the chances for a further pullback is huge. And lastly, by the way, don’t hope too much about the month end window dressing, because according to the Stock Trader’s Almanac, the last trading day of March, Dow down 10 of last 15.

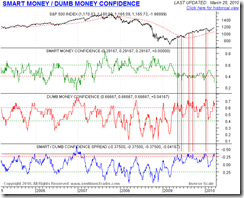

The chart below is one of the major indicators in Sentimentrader. The Smart / Dumb money confidence spread keeps enlarging, not a good sign. Well, again, throw this into the table above. Hope you all know how to use the table above now.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Looks like it’s too late to long stocks now as the market is way too overbought. Waiting for a better chance.