|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: NO UPDATE

CYCLE ANALYSIS: THE NEXT IMPORTANT DATE IS 04/20

The market could rebound to 04/20 (+-) then pullback to 05/06 (+-)? See 04/16 Market Recap for more details.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD

Maintain the forecast for Roller Coaster ahead for 3 reasons:

- According to the II Survey, too many people expected a correction, so the stock market should rise to a new high first before actually pulling back (See 03/19 Market Recap for more details). Since we’ve seen the new high so now it’s the pullback’s turn.

- Statistically when the market has been up, especially at a 52 week high, entering the earnings season, the average performance during earnings season is usually not good (See 04/09 Market Recap for more details).

- 6.1.0 Extreme CPCE Readings Watch, take a look at how the market behave when CPCE was extremely low. I expect no difference this time (choppy ahead like past) especially when there’re simply so many bearish extremes accumulated in the table above.

SHORT-TERM: IF STILL THE SAME OLD MAJOR DISTRIBUTION DAY PATTERN THEN THE MARKET WAS BOTTOMED

As mentioned in the 04/16 Market Recap, if green or small red today then according to the past Major Distribution Day pattern, most likely the market was bottomed. However, because there’re still too many bearish extremes in the table above, so my guess is that the market may not go too far this time, therefore today might be just a short-term bottom (assume there’s a follow through tomorrow).

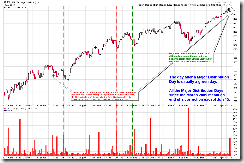

From various daily chart, I see Bullish Reversal Bars everywhere so the chart pattern also argues that the market was bottomed, of course a follow-through is needed tomorrow to confirm the reversal. The chart below shows all the past hollow red bars on the QQQQ daily chart, take a look at what happened thereafter yourself.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Looks like it’s too late to long stocks now as the market is way too overbought. Waiting for a better chance.