|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: NO UPDATE

CYCLE ANALYSIS: THE NEXT IMPORTANT DATE IS 04/20

The market could rebound to 04/20 (+-) then pullback to 05/06 (+-)? See 04/16 Market Recap for more details.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD

Maintain the forecast for Roller Coaster ahead for 3 reasons:

- According to the II Survey, too many people expected a correction, so the stock market should rise to a new high first before actually pulling back (See 03/19 Market Recap for more details). Since we’ve seen the new high so now it’s the pullback’s turn.

- Statistically when the market has been up, especially at a 52 week high, entering the earnings season, the average performance during earnings season is usually not good (See 04/09 Market Recap for more details).

- 6.1.0 Extreme CPCE Readings Watch, take a look at how the market behave when CPCE was extremely low. I expect no difference this time (choppy ahead like past) especially when there’re simply so many bearish extremes accumulated in the table above.

SHORT-TERM: COULD BE SOME WEAKNESS AHEAD

There’re 2 not so bull friendly signals today, plus the All Up Day mentioned in today’s After Bell Quick Summary, so my guess is we could see some weakness in a very short-term.

0.2.2 Extreme Put Call Ratio Watch, CPCI is a little bit too high. The fact it rose big, meaning big guys bought lots of index put on a strong up day like today is a little bit suspicious.

6.2.3 VIX:VXV Trading Signals, a little bit too low now. VIX to VXV ratio seemed worked OK recently.

Another very interesting thing today was that the Nasdaq Intraday Cumulative TICK (courtesy of sentimentrader) skyrocketed again. Very very bullish, perhaps a little bit too bullish. The last time I WOW-ed was in the 04/14 Market Recap. Coincidence? Well, we’ll see.

The chart below explains why the Nasdaq Intraday Cumulative TICK skyrocketed today, because there’s no minus TICKQ almost whole day today as everybody rushed to buy buy buy and buy, this really is bullish.

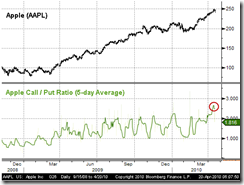

Let’s take a look at how many people bought AAPL CALLs (from sentimentrader morning report). Well, judging by AAPL AH actions, everybody will be rich tomorrow morning at open. Making money could be that easy, no wonder I had a reader asking me this morning, since all the bearish signals in the table above didn’t work why bother mentioning them! Well, that’s certainly was a good question.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Looks like it’s too late to long stocks now as the market is way too overbought. Waiting for a better chance.