A very interesting thing I noticed is that the VIX rose sharply before the close while SPX was still rising. Checking the CBOE intraday volume, I found a spike of index put buying right before the close and that’s why the VIX rose sharply. Either people simply hedged their positions for the weekend or some big guys knew that something terrible is going to happen in the weekend. I don’t know which case will be, but if I remember correctly, whenever this kind of thing happens, it usually means a gap down open the next day. (For observation only, so that I’d know what to do the next time the same thing happens.)

Two tricks say a green day the next day. The magic bullish Monday and the CPC <= 0.81.

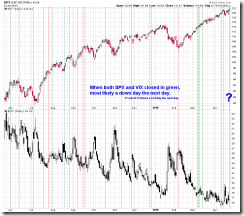

In case you still want to know there’s no apparent edge when both VIX and SPX closed in green on the same day.