|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: MONDAY AND FRIDAY ARE BULLISH

According to the Stock Trader’s Almanac:

- First trading day in May, Dow up 9 of last 11.

- Friday before Mother’s day, Dow up 9 of last 14.

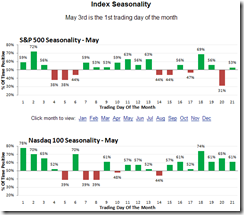

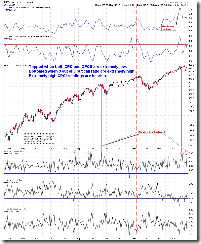

The chart below is the May Seasonality (courtesy of sentimentrader) for SPX and NDX.

CYCLE ANALYSIS: THE NEXT IMPORTANT DATE IS 05/06

The next potential turn date is 05/06 (+-) which could either be a top or a bottom depending on how the market marches to that date. See 04/16 Market Recap for more details.

1.0.7 SPX Cycle Watch (Daily), there’re 2 cycle due date the next and next next week, 05/03 and 05/10, together with the above mentioned 05/06, my guess is that they could mean a cycle top. Yes, I’ve double checked to make sure I didn’t write it wrong, it is a cycle top. For reasons please refer to the intermediate-term session below.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD OR THE MARKET COULD BE TOPPED

Maintain the forecast for roller coaster ahead (see 04/26 Market Recap for more details). Upgrade the warning level today, as there’re good chances that an intermediate-term top is imminent. The “witness” is the weekly Bearish Engulfing pattern formed this week. The charts below highlighted in red ( only Bearish Engulfing formed at 10 week high are listed) since 1988, all SPY weekly Bearish Engulfing bars. Total 11 cases, only 2 cases the market kept going higher and higher thereafter. In another word, there’re 82% chances, the market has topped (or very close).

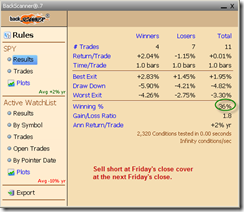

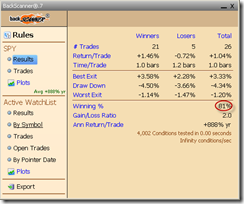

I think some of you may remember my “rule” for Bearish Engulfing: A Bearish Engulfing usually means bullish the next bar (in our case means bullish the next week), the chart below is the back test summary – sell short at Friday’s close, buy cover at the next Friday’s close, bears got only 36% chances.

If however hold until next next week, buy cover at the next next Friday’s close then bears got 82% chances. So the conclusion is bullish next week, but not so bull friendly after the next week.

Below is another reason for not very pleasant ahead. Climax Buying (where a stock makes a new 52 week high but then closes below the previous week’s close.) among SPX stocks reached a record high this week. See what happened after all those vertical lines. Again it doesn’t necessarily mean a red week the next week, but certainly a strong sign to at least raise a cautious flag.

SHORT-TERM: COULD SEE GREEN MONDAY BUT MORE PULLBACKS AHEAD

I mentioned 2 reasons for a green Monday in the Friday’s After Bell Quick Summary. Here’s the 3rd reason: 0.2.0 Volatility Index (Daily), VIX rose more 19% on Friday, from the back test summary below, buy at close sell at the next day’s close, bulls got 81% chances.

0.2.2 Extreme Put Call Ratio Watch, however on a little bit longer than the next Monday, here’s another top sign, see thick vertical red lines for what happened when CPCI closed above 2. At least it means a short-term top.