|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals.

SEASONALITY: MONDAY AND FRIDAY ARE BULLISH

See 05/14 Market Recap for more details.

INTERMEDIATE-TERM: PULLBACK TARGET AROUND 1008 TO 1019, COULD LAST TO 05/23 AT LEAST

Since either Diamond Bottom or Head and Shoulders Bottom mentioned yesterday are not fulfilled, so still temporarily maintain the previous forecast below:

- 05/06 low may be broken but no evidence says this is a start of a new bear market. See 05/07 Market Recap for more details.

- The pullback could last to 05/23 at least. See 05/10 Market Recap for more details.

- The pullback target could be around 1008 to 1019 area. See 05/14 Market Recap for more details.

However, strictly speaking, as mentioned in today’s After Bell Quick Summary, it’s possible that a Double Bottom could be in the forming, so the market direction is not very clear, need see tomorrow. Just because the major signals (SPY ST Model and Non-Stop) in the table above are “sell”, so before I have any solid evidences to prove that indeed the market is bottomed, I’ll maintain bearish bias here (so called innocent until proven guilty). Besides, from chart 0.1.0 SPY Short-term Trading Signals, could be a Stick Sandwich formed, which means bearish continuation 62% of the time, also support a little bit bearish bias here.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: WATCH MA(200)

Again, before reading the session below pleas read the WARNING above and make sure you understand how to use the table above. I simply provide info here, so by no means I imply that you should take the trade.

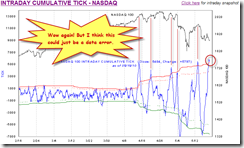

Begin with the conclusion first: If the Intraday Cumulative Tick reading is true then tomorrow won’t be pleasant, but if SPY eventually could close above MA(200), then we could at least see a short-term rebound very soon.

Intraday Cumulative Tick from sentimentrader, I mentioned this in today’s After Bell Quick Summary because I really suspect it’s a data error. However in case it’s not a data error, I want to remind you the last 5 times I mentioned the same skyrocket high cumulative tick readings were in the 05/13 Market Recap, 05/03 Market Recap, 04/29 Market Recap, 04/20 Market Recap and 04/14 Market Recap.

According to TradingMarkets 2 day cumulative RSI(2) strategy (see table above), we should long SPY at close today. Pay attention to bars highlighted in green(not all are 2 day cumulative RSI(2) strategy, but mostly similar), plus the pink curve below – percent of SPX stocks 2 std dev below MA50 is a little bit too high, therefore this short-term trading setup might be doable, especially if another cumulative RSI(2) buy setup could be triggered with SPY hold above MA(200) (Must close above MA(200) otherwise the setup is invalid) tomorrow, then statistically chances are very good that we may see at least a short-term rebound very soon.