|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

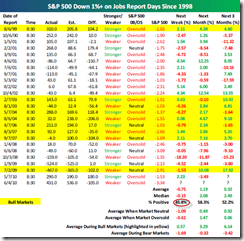

SEASONALITY: A LITTLE BIT BEARISH BIASED THE NEXT WEEK

Friday is the worst ever NFP day since 1998, the chart below is from Bespoke, overall, a little little bit bearish biased the next week.

INTERMEDIATE-TERM: PULLBACK TARGET AROUND 1008 TO 1019, TIME TARGET AROUND 06/11 TO 06/14

Whether the 05/26 low is THE LOW has been the puzzle for quite awhile because unlike the past bottom pattern, there’s no visible positive divergence yet. The Friday’s sell off may have solved the puzzle: Probably, possibly, maybe, this time is no difference than the past, the NYMO positive divergence is required before SPX could be bottomed. In another word the 05/26 low will be broken (so that NYMO is able to form a positive divergence). So maintain the pullback target around 1008 to 1019, however will update the time target to around 06/11 to 06/14 (if no miracle next Monday then the previous time window around 06/05 to 06/06 should be counted as fulfilled because the 06/03 cycle top is close enough).

“EXCUSES” for supporting the statement above are listed below.

Why the 05/26 low could be broken eventually? Three reasons:

0.1.0 SPY Short-term Trading Signals, Evening Star which means bearish reversal 72% of the time.

1.0.0 S&P 500 SPDRs (SPY 60 min), Double Top which has 73% chances to meet the text book target.

6.4.1 Extreme NYADV Readings Watch, extremely low NYADV reading almost guarantees that SPX will have a lower close ahead.

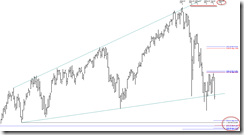

Why the pullback target could be around 1008 to 1019? See chart below, multiple targets deduced from various angles confluence in a small area which should mean something.

- Ascending Broadening Wedge text book target is 1019.

- The Fib 38.2% of Oct 2007 high to Mar 2009 low is 1014. (see 4.1.0 S&P 500 Large Cap Index (Weekly))

- The Fib 38.2% of April 2010 high to Mar 2009 low is 1008. (see 4.1.0 S&P 500 Large Cap Index (Weekly))

- Assume the pullback starting from 06/03 is equal to Fib 61.8% of the April 26 high to May 6 low then the target is 1010.

- Assume the pullback starting from 06/03 is equal to Fib 61.8% of the May 13 high to May 25 low then the target is 1023.

- Double Top text book target is 1015.

Why the time target could be around 06/11 to 06/14?

See the top right corner of the chart above, interestingly the correction starting from 04/26 has the pattern of being pullback for 8 days then rebound for 5 days, so if repeats again a 8 days pullback then the time target could be around 06/14.

Also from the Gann Day table below, multiple Gann Days due on 06/11 to 06/14. And besides whether you believe or not, 06/12 is the new moon which also could be a potential turning date.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: COULD SEE HUGE REBOUND MONDAY BUT WILL SEE A LOWER SPX CLOSE AHEAD

I’ve mentioned 2 reasons for expecting a green Monday on the Friday’s After Bell Quick Summary. Here’s the 3rd reason. The chart has already posted in the intermediate-term session above, which is 6.4.1 Extreme NYADV Readings Watch. Although extreme low NYADV means a lower close ahead, but if you’ve noticed the blue cycles in the chart then you should’ve found that interestingly the market usually rebounded huge the next day after an extreme low NYADV day. Will this time be different? Well, we’ll see.