|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: WEEK AFTER JULY EXPIRATION, DOW DOWN 7 OF LAST 11

See 07/16 Market Recap for more details.

INTERMEDIATE-TERM: THE CORRECTION ISN’T OVER YET

See 07/02 Market Recap and 07/16 Market Recap for more details.

SHORT-TERM: DIRECTION NOT CLEAR, A LITTLE BIT BEARISH BIASED THOUGH

The SPY’s daily chart doesn’t look good today, a Dark Cloud Cover is formed which means a bearish reversal 60% of the time. However before seeing a follow through tomorrow, all I can say are that the market direction is not clear.

Although the direction is not clear, but from all the evidences I’ve gathered I’m leaning toward a little bearish biased, especially seeing the liquidity chart below(courtesy of stocktiming). Although the market up big yesterday but there wasn’t much liquidity inflow. My guess is only the Quantitative Easing II could solve the liquidity problem although I truly believe that Quantitative Easing II would only make things worse. Well, I’m not supposed to discuss issues other then TA in my daily report, so I’ll stop here.

The chart below shows all the SPY bearish reversal bars since the March 2009 rally. It does not look bull friendly. Although not necessarily mean a down day tomorrow but with no exception, the low today is not THE LOW.

6.2.3 VIX:VXV Trading Signals, I know I’ve been blah blah about this chart for awhile, well, it’s still too low, so if the market keeps rebounding from here, I still suspect how far it could go. Please refer to 07/20 Market Recap for why I say so.

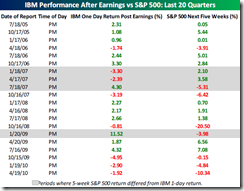

IBM fell after ER yesterday, interestingly, according to Bespoke, IBM’s one day return (positive or negative) following earnings has been the same direction as the S&P 500 over the next five weeks 77% of the time:

Since 2001, IBM has traded up on the day after its earnings report 20 times. In the five weeks following those twenty periods, the S&P 500 has averaged a gain of 2.2% with positive returns 80% of the time. There have been fifteen occurrences where IBM traded down on the day following its earnings report. In the five weeks following those periods, the S&P 500 has averaged a decline of 3.7% with declines 73% of the time.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST