|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

SEASONALITY: NO UPDATE

INTERMEDIATE-TERM: STATISTICS ARE BEARISH

See 08/20 Market Recap for more details.

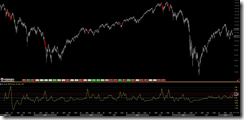

Remember the T2105 back test I mentioned in 08/20 Market Recap? Since T2105 keeps making new high since then, so I tightened the test conditions: Sell short at close when MACD(10, 200, 1) > 0.60 (so called normalizing), cover when MACD(10, 200, 1) < 0.60 since year 2000. The test results below should be clear enough, so I won’t bother to blah blah here again.

The chart below is the visual back test of the above test results. For you to “feel” it like feel the force around you sort of feel.

SHORT-TERM: THE 07/01 LOW MAY BE TESTED

The bottom line:

- Since both Head and Shoulders Top and Rising Wedge text book target point to the same 07/01 low, so the 07/01 low may be tested.

- The next important pivot date is around 08/26(+-).

- Since the selling this time is weaker than the previous 3 times since 04/26, so the bullish call is a potential Head and Shoulders Bottom in the forming. Personally, however, I won’t put my bet on this though.

1.0.0 S&P 500 SPDRs (SPY 60 min), this chart explains why the 07/01 low may be tested.

The chart below should also clearly explain why 08/26 is an important date. Especially, if you’ve noticed that the 2 of the most important dates so far this year were 04/26 high and 05/25 low, both happened around date 26. In addition I also have a 3rd party document (cannot be disclosed yet) claiming that 08/26 is very important. As for whether 08/26 is low or high, is hard to say. Just if the market pullbacks to 08/26 and at the same time reaching the 07/01 low at SPX 1010 or SPX 1040 (for possible Head and Shoulders Bottom as shown on the chart below), then chances are good that 08/26 could be an important low.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | DTMFS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | *DOWN | SELL | |

| IWM | *DOWN | SELL | |

| CHINA | UP | Head and Shoulders Bottom in the forming? | |

| EMERGING | UP | SELL | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| EUROPEAN | DOWN | SELL | |

| CANADA | UP | SELL | |

| BOND | UP | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). | |

| EURO | DOWN | SELL | |

| GOLD | UP | ||

| GDX | UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. | |

| OIL | DOWN | SELL | |

| ENERGY | DOWN | SELL | |

| FINANCIALS | DOWN | SELL | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | *DOWN | SELL | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging, be careful. |

| MATERIALS | *DOWN | SELL |

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.