|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

SHORT-TERM: EXPECT PULLBACK SOON

I believe a top of some kind might be close now. Not sure whether we could see another up day tomorrow because we may see 911 patriotic rally as mentioned in today’s After Bell Quick Summary. Besides, around Rosh Hashanah holiday, the volume is low, so normally big guys won’t sell around those holidays as there’s not much buying power to absorb the selling, to sell on those low volume days won’t get good price unless something terribly terrible happens. So according to this theory, the sell off tomorrow, if any, should be fairly limited.

For your conveniences I’ve put all the top signals below:

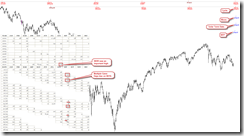

I mentioned the 09/07 to 09/10 time window in 08/27 Market Recap. The 2 charts below should be clear enough on how I get the time window and since both price and time target are now met, so theoretically the market should change directions around here.

6.4.6a QQQQ Black Bar Watch, I’ve mentioned this in today’s After Bell Quick Summary. A top of some kind should be very close.

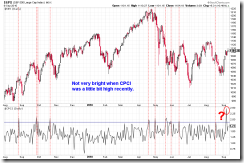

0.2.2 Extreme Put Call Ratio Watch, don’t forget the story of an extremely high CPCI.

0.2.5 NYSE Total Volume, another low volume up day, another top sign.

1.0.0 S&P 500 SPDRs (SPY 60 min), the RSI negative divergence mentioned yesterday is now fulfilled plus a bearish Rising Wedge could be in the forming which is known as an ending pattern.

1.0.6 SPY Unfilled Gaps, lastly, don’t forget the back to back unfilled gaps formed on 09/07 and 09/08. They should be filled very soon. Besides, even in the most bullish days last year, the max unfilled gaps were 18, now we’ve already got 16. I don’t see now is even more bullish than that of last year, so the 16 unfilled gaps are too much, some of them should be filled very soon.

INTERMEDIATE-TERM: EXPECT 3 LEG UP, MINI SPX 100 POINT FROM 08/27 CLOSE

See 09/03 Market Recap for more details.

SEASONALITY: SEPTEMBER IS BEARISH

See 09/03 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | DTFMS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | ||

| IWM | LA | ||

| CHINA | UP | Head and Shoulders Bottom in the forming? | |

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. | |

| EUROPEAN | *UP | ||

| CANADA | DOWN | *TOADV MA(10) too high, may pullback further. | |

| BOND | *DOWN | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). | |

| EURO | DOWN | ||

| GOLD | *DOWN | SELL | |

| GDX | DOWN | *SELL | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high, pullback? |

| OIL | *DOWN | 4.4.0 United States Oil Fund, LP (USO Weekly): USO to SPX ratio too low, rebound? | |

| ENERGY | LA | ||

| FINANCIALS | *UP | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? | |

| REITS | *DOWN | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging and IYR to SPX ratio too high. | |

| MATERIALS | *LA |

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

*LA = Lateral Trend.