|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: MAY SEE REBOUND TOMORROW BUT PULLBACK IS NOT OVER YET

Although the chart pattern can be seen as a Head and Shoulders Bottom breakout then back test neckline therefore officially bull’s gesture is not bad. However, from all the bad signs I’ve been reporting, at least short-term is not bull friendly, a top was in or very close.

Begin with good news first. We may see rebound tomorrow, the argument is TICK MA(3) too low. Besides, if a red day again tomorrow, don’t forget the back test I mentioned in 08/13 After Bell Quick Summary: Buy at the SPY 4th consecutive red close and hold until the first up day since year 2000, you have 82% chances to win something.

Listed below are the summaries of all the bad signs I’ve mentioned recently where “*” means a newly added signal today.

- 09/21 to 09/23 pivot date mentioned in 09/17 Market Recap seems worked.

- 1.0.6 SPY Unfilled Gaps, 17 unfilled gap, the max was 18. Don’t forget there’re back to back unfilled gaps between 09/02 and 09/08.

- 6.4.3a SPY Bearish Reversal Day Watch, SPY bearish reversal day on 09/21.

- The VIX negative divergence and closed below EMA(20) before SPY mentioned in 09/21 Market Recap which usually lead to a trend change.

- 6.5.1a SPX and FOMC, red FOMC followed by a red day was a bad sign.

- 6.3.1b Major Accumulation Day Watch, 2 consecutive red days after a Major Accumulation day was a bad sign.

- *1.1.1 PowerShares QQQ Trust (QQQQ Daily), 2 hollow red bars in a row, looks toppy.

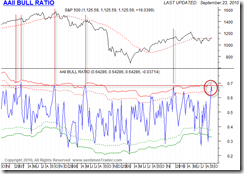

- *09/16 AAII was too bullish, while the most up to date AAII still is too bullish.

- *SPX down 3 consecutive days in an uptrend usually means more pullbacks ahead.

- Just a reminder, don’t forget 6.5.2b Month Day Seasonality Watch and 6.5.2c Week Seasonality Watch, next week is not bull friendly.

Now let’s take a look at those 3 newly added bad signs especially pay attention to SPX down 3 consecutive days, as I’ve been saying: a strong uptrend should never have 3 consecutive down days.

SPX down 3 consecutive days in an uptrend usually means more pullbacks ahead.

The back test summary below simply says: SPX down 3 days in a row, 79% chances there’d be a close that is below today’s close within 10 days since year 2000. This should prove the above mentioned conclusion – more pullbacks ahead.

The latest AAII Bull Ratio.

1.1.1 PowerShares QQQ Trust (QQQQ Daily).

INTERMEDIATE-TERM: STATISTICALLY BULLISH FOR THE NEXT 2 WEEKS

We could see 2 to 3 legs up while now is the very first leg up. See 09/17 Market Recap for more details.

SEASONALITY: WEEK AFTER SEPTEMBER TRIPLE WITCHING DOW DOWN 6 OF LAST 7

According to Stock Trader’s Almanac, week after September Triple Witching, Dow down 6 of last 7. Five in a row 2002 – 2006 with heavy losses 2002 – 2005. Also see September’s Triple Witching for more statistics.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ | *LA | 4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. *1.1.1 PowerShares QQQ Trust (QQQQ Daily): 2 hollow red bars in a row, pullback? |

| IWM | DOWN | |

| CHINA | ||

| EMERGING | *DOWN | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. 1.4.1 iShares MSCI Emerging Markets (EEM Daily): Black bar under resistance, pullback? |

| CANADA | DOWN | TOADV MA(10) too high, pullback? |

| BOND | UP | *Black bar, pullback? |

| EURO | UP | |

| GOLD | UP | |

| GDX | *LA | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high and Bearish Engulfing. |

| OIL | *LA | *Bullish reversal bar, rebound? |

| ENERGY | DOWN | *Hollow red bar, not sure it means top or bottom. |

| FINANCIALS | DOWN | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | DOWN | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging and IYR to SPX ratio too high. |

| MATERIALS | *DOWN |

Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented. Any good/bad signs can be confirmed and confirmed and confirmed, there’s no end of confirmation, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to various risk levels therefore please don’t expect me to give specific buy/sell signals here.

* = New update.

Blue Text = Link to a chart in my public chart list.

LA = Lateral Trend.