|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: NO FOLLOW-THROUGH AFTER EACH HUGE UP DAY, DOESN’T FEEL LIKE A STRONG UPTREND

As mentioned in yesterday’s report, today must close in green otherwise it’d be a bad sign for having 2 consecutive red days after a Major Accumulation Day. Unfortunately, not only today we have 2 red days in a row but also it’s a bearish reversal day. From charts below we can see, both cases could mean some short-term weakness ahead.

Frankly, although now feels that Fed or YES WE CAN are capable of anything therefore the stock market would fly to the sky, but in reality:

- All the 3 huge up day we had recently had no follow-through thereafter while instead each kept having more and more reversal like bars.

- As mentioned in 10/04 Market Recap, QQQQ down 6 days in a row normally happened only in an intermediate-term downtrend.

Put all above together, this simply doesn’t feel like a strong uptrend. So my conclusion is:

- Although I’m not implying that you should short but at least don’t get too bullish now.

- 10/05 to 10/11 may indeed contain an important pivot date which could mean a top of some kind.

- For intermediate-term, I’ll reiterate the bearish view.

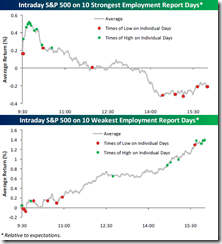

As for tomorrow’s Non Farm Payroll, except all I’ve mentioned in today’s After Bell Quick Summary, let me quote Bespoke again:

If Friday’s report comes in significantly stronger and the market opens up, history says not to chase it. If the report comes in much weaker than expected and the market opens down, investors should look to buy on weakness.

INTERMEDIATE-TERM: SEEMS 11%+ RISE GUARANTEED BEFORE YEAR END, I’M SKEPTICAL HOWEVER

See 10/01 Market Recap for details.

SEASONALITY: OCTOBER IS BULLISH

See 10/01 Market Recap for October Seasonality chart.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ | *UP | 4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. |

| IWM | UP | |

| CHINA | ||

| EMERGING | *LA | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| CANADA | UP | TOADV MA(10) too high and has negative divergence. |

| BOND | *DOWN | |

| EURO | UP | *Bearish Reversal Bar, pullback? |

| GOLD | *LA | *Bearish Engulfing, pullback? |

| GDX | *DOWN | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. *3.2.1 Market Vectors Gold Miners (GDX Daily): Bearish Engulfing, pullback? |

| OIL | *DOWN | *Bearish Engulfing, pullback? |

| ENERGY | UP | *Bearish Reversal Bar, pullback? |

| FINANCIALS | *LA | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? *3.4.0 Financials Select Sector SPDR (XLF Daily): Bearish Engulfing, pullback? |

| REITS | UP | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging. *3.4.1 Real Estate iShares (IYR Daily): Black bar, pullback? |

| MATERIALS | UP | *Bearish Engulfing, pullback? |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no specific buy/sell signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update.

- Blue Text = Link to a chart in my public chart list.

- LA = Lateral Trend.