|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: BEARISH BIASED

The only story today is that VIX:VXV hit a record low which translates into SPX price is to say that SPX price will be much lower than that of now in 3 months. However, see chart below, since the mother nature has the tendency to make things symmetrical, so there’s a chance that VIX:VXV mirrors what happened in October 2008 which means it will go extremely extremely low and translates into SPX price is to say pretty soon, we’ll see SPX all time high and perhaps SPX 2000 something is not a problem at all (hmm, I think I’ve seen my yacht to be, really big and beautiful…). Well, which way will it be, use your common logic, but don’t forget, in this new era of YES WE CAN, trading really needs some imagination so perhaps a yacht in the next 3 months may not be a dream at all?

Personally, all I can tell you (as I’ve been doing for years here in my blog) is the history. From the chart below, at least recently when VIX:VXV is extremely low, it’s not very pleasant for bulls thereafter.

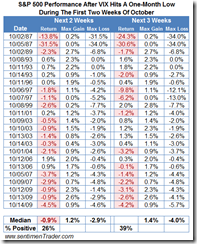

I know, inevitably we’ll see some reports saying the dramatic drop of VIX today was due to some other factors. Well, the statistics below is from sentimentrader for VIX last Friday’s readings, it says according to the history, a very low VIX is not very friendly to bulls. So it seems to me whether the VIX drop today is for other factors or not, doesn’t matter because VIX was already low enough to be considered as not so bull friendly.

INTERMEDIATE-TERM: BEARISH BIASED

Maintain the intermediate-term bearish view. Below are summaries of all the arguments I’ve been blah blah recently:

- As mentioned in 10/08 Market Recap, commercial (smart money) holds record high short positions against Nasdaq 100.

- As mentioned in 10/08 Market Recap, AAII bull ratio (4-week average) is way too bullish.

- As mentioned in 10/08 Market Recap, institution selling keeps increasing.

- As mentioned in 10/08 Market Recap, statistically, a strong off-season could mean a weaker earning season.

SEASONALITY: OCTOBER EXPIRATION MONAY WAS BULLISH, EXPIRATION DAY WAS BEARISH

According to Stock Trader’s Almanac:

- Monday before October expiration, Dow up 24 of 29.

- October expiration day, Dow down 4 straight and 5 of last 6.

For October Seasonality chart please refer to 10/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ | UP | 4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. |

| IWM | UP | |

| CHINA | Confirmed breakout, very bullish. | |

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| CANADA | UP | TOADV MA(10) too high and has negative divergence. |

| BOND | DOWN | |

| EURO | *LA | |

| GOLD | UP | |

| GDX | UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. 3.2.1 Market Vectors Gold Miners (GDX Daily): Bearish Engulfing, pullback? |

| OIL | *DOWN | |

| ENERGY | UP | |

| FINANCIALS | UP | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | UP | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging. |

| MATERIALS | UP | *Bearish Reversal Bar, pullback? |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no specific buy/sell signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update.

- Blue Text = Link to a chart in my public chart list.

- LA = Lateral Trend.