|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

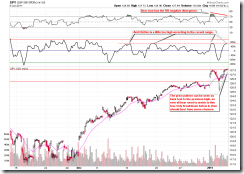

SHORT-TERM: COULD SEE MORE ON THE UPSIDE

As mentioned in today’s After Bell Quick Summary, the intraday pattern looks like a Bull Flag, so chances are good that we may see more on the upside.

For bears, every time the market pulls back then rebounds to test the previous high, there’s a chance that it could be a pivot point. Now plus the RSI negative divergence and the ChiOsc a little high and the time resistance mentioned yesterday, so bear may still have some chances. Well, I really want to say here is now both bear and bull are equally carry high risk, so trade with caution.

The last chart I want to show you is yet again the ISEE Equities Only Index closed above 300 which is way too bullish. Well, I know you’re already numbed about such a such so called extremes, LOL.

INTERMEDIATE-TERM: COULD BE WAVE 5 UP TO SPX 1300+, PIVOT TOP COULD BE AROUND 01/05 TO 01/12

See 12/31 Market Recap for more details.

SEASONALITY: BULLISH TUESDAY, JANUARY’S 1ST 5 DAYS IS AN EARLY WARNING SYSTEM

See 12/31 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | *01/05 S | |

| NDX Weekly | UP | |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | UP | Should have set the trend to down from up but I’ll see how the market rebounds. |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 12/02 L | TOADV MA(10) a little too high. |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | UP | |

| FXE | ||

| FXE Weekly | DOWN | |

| GLD | Could be an Ascending Triangle in the forming. | |

| GLD Weekly | UP | |

| GDX | 12/17 S | Watch for potential 1-2-3 trend change. If GDX topped then be careful about gold itself. |

| GDX Weekly | UP | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 06/15 L | |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 12/01 L | |

| XLB Weekly | UP | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.