|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: EXTREMELY HIGH CPCI READINGS COULD MEAN SOME WEAKNESS AHEAD

Still the new high today isn’t decisive enough, so bears still have hopes, especially according to 6.5.2b Month Day Seasonality Watch, the last 2 trading days of each month since August 2009 were bearish, so let’s give bears a few more days. By the way, I’ve removed some bearish signs in the table above, except some apparently failed signals, some on the 2nd thought, are too vague to judge in the future if indeed they worked, so I decide to clean them too. Well, you can consider this as my way of capitulation (on bearish view), LOL.

Two things I’d like your attention for today:

- 0.2.2 Extreme Put Call Ratio Watch, CPCI too high could mean at least a short-term top. Like almost all the other signals, it didn’t work well recently but after all it still worked, so let’s see.

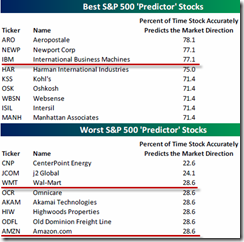

- AMZN dropped sharply after ER in AH, which actually is a good news for bulls, assuming AMZN indeed red tomorrow. Remember what I mentioned in 01/18 Market Recap? Where I said the IBM one day return on earnings predicts the SPX over the next 5 weeks 80%+ of the time. Well, AMZN is the opposite, which means AMZN red on ER most likely means SPX green over the next 5 weeks. So let’s give it a little attention tomorrow on how AMZN closes. The statistics below are from Bespoke (up to July 2010).

INTERMEDIATE-TERM: IN WAIT AND SEE MODE, WHETHER THE 01/18 HIGHS IS THE WAVE 5 HIGH REMAINS TO BE SEEN

Since even the short-term I have no answer for whether the pullback is over, so whether the intermediate-term was topped, we’ll have to wait and see.

SEASONALITY: THE LAST 2 TRADING DAYS OF EACH MONTH SINCE AUGUST 2009 WERE BEARISH

See 01/21 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | *01/27 L | |

| NDX Weekly | UP | BPNDX is way too overbought. |

| IWM | ||

| IWM Weekly | DOWN | No lower low to confirm yet, but the sell off is strong, so downgrade the trend to down from up. |

| CHINA | ||

| CHINA Weekly | DOWN | |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 01/06 S | |

| XIU.TO Weekly | UP | |

| TLT | 0.2.1 10Y T-Bill Yield: Symmetrical Triangle? So bond should keep falling? | |

| TLT Weekly | ? | |

| FXE | 3.1.1 US Dollar Index Bullish Fund (UUP Daily): 1-2-3 trend change, UUP could be in downtrend. | |

| FXE Weekly | UP | No higher low to confirm yet but the rebound is strong, so I upgrade the trend to up from down. |

| GLD | ||

| GLD Weekly | *DOWN | |

| GDX | 12/17 S | |

| GDX Weekly | DOWN | |

| USO | ||

| WTIC Weekly | *DOWN | |

| XLE | 01/25 S | |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | UP | Testing resistance which also is multiple Fib confluences area. |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 01/19 S | |

| XLB Weekly | DOWN | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.