|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: COULD SEE NEW HIGH SOON

The bottom line, trend is up both short-term and intermediate-term. Why? Because so far despite the volatility, there’s not even a lower low on the intraday chart yet. Considering the statistics given by 02/23 Market Recap and 03/01 Market Recap, plus what I’ll mention in the intermediate-term session below that ISEE Equities Only Index closed above 200 while SPX down 0.7%+ could mean a bullish next few days, so I’ll temporarily maintain the forecast that we could see a new high soon.

4.1.3 Volatility Index (Weekly), could be bullish for stocks, because 2 weekly Doji looks bearish (for VIX).

INTERMEDIATE-TERM: COULD NOT BE VERY BRIGHT

There’re several evidences supporting my view for a bullish short-term while have a doubt about the intermediate-term. Again and again, I don’t mean you should short as speculation is merely a speculation until price confirms, for now the trend is clearly up, no doubt.

The very unique thing on Friday is while the market was down sharply but retailers were buying dips like crazy which can be seen from ISEE Equities Only Index that closed astonishingly above 275. Buy SPY at the Friday close and sell the next Monday, seems bullish while not very pleasant if hold for 2 weeks.

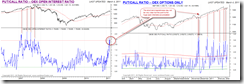

Another unique thing on Friday is while retailers were buying calls like crazy, big guys put OEX like crazy causing OEX put call ratio to spike AGAIN. The bearish bias for such kind of high OEX put/call ratio is not very clear at least recently but if you take a look at the OEX Open Interest Ratio, then the intermediate-term could be choppy and eventually there would be a sharp pullback.

Besides, the Friday Non Farm Payroll day, especially a red day usually have some chances to be a pivot point which in our case means around an intermediate-term top.

Time analysis wise, except the New Moon and Solar Term date (see table above), once again we’re in the time window called Magic Day 6 which could also mean a pivot day around.

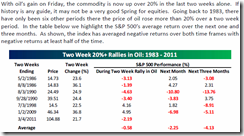

The last but not the least, maybe beyond the TA discussion and doesn’t count as the evidence for calling not so bright intermediate-term. Just curious, as I find very hard to imagine that when SPX goes back to all time high, how high the commodity would go? The statistics below is from Bespoke, sure, YES WE CAN is capable of anything so joke only, as history won’t repeat this time or will it?

SEASONALITY: NO UPDATE

For March seasonality chart please refer to 03/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | |

| NDX Weekly | UP | |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | UP | |

| EEM | ||

| EEM Weekly | *UP? | |

| XIU.TO | 02/04 L | |

| XIU.TO Weekly | UP | *Too far above MA(200). |

| TLT | Could be a channel breakout, trend may about to change. | |

| TLT Weekly | ? | |

| FXE | ||

| FXE Weekly | UP | *Testing Fib confluences area. |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 02/03 L | |

| GDX Weekly | UP | |

| USO | *ChiOsc is way too high. | |

| WTIC Weekly | UP | *Too far above BB top. |

| XLE | *03/04 L | |

| XLE Weekly | UP | Too far above MA(200). |

| XLF | 10/15 L | |

| XLF Weekly | ? | Small lower low wait for follow through to confirm the trend change. |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 02/09 S | |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.