|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: 90% CHANCES A GREEN DAY TOMORROW

Three cents:

- 90% chances a green day tomorrow.

- Maintain the forecast mentioned in 03/25 Market Recap, expect some weakness this week.

- Trading wise, I longed at the close but if the market kept selling off tomorrow, I’d be on the bear side. The long position will be held until the stop loss being hit which is fairly large – below the 03/23 lows.

As mentioned in today’s After Bell Quick Summary, although there’re some chances that today’s intraday high is the 3rd push up (as per my evil plan) but since the RSI negative divergence is not large enough, so chances are better that we may see the 3rd push up tomorrow.

The two evidences listed below not only argue for a green day tomorrow but also are the reasons that I’m willing to bet my face (well, do I still have face?) on maintaining the forecast mentioned in 03/25 Market Recap that we’ll see some weakness ahead.

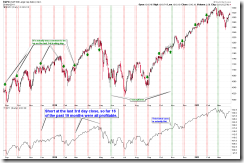

Statistically the Bearish Engulfing formed on today’s SPY daily chart means 90% chances a green day tomorrow. However it also shows a little bearish bias in 5 days.

6.5.2b Seasonality – Last Few Days of the Month, pay attention to green arrows, the chart basically says, likely green tomorrow but not pleasant the day after tomorrow and the day after the day after tomorrow. LOL

The 3rd evidence argues for a short-term pullback at least. 6.4.3a SPY Bearish Reversal Day Watch, even not long ago when nothing bearish ever worked this chart sill stood, so I think the pattern is pretty reliable.

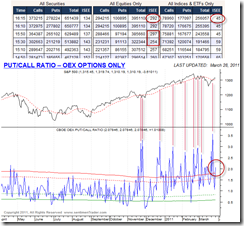

The last but not the least, let me answer the question raised in today’s After Bell Quick Summary: The 290+ ISEE Equities Only Index readings are very extreme, even within the top 10 extreme readings in the entire ISEE Index history. This means the retailers are way too bullish therefore I don’t think it’s a bullish sign. To make things worse, the chart below shows, clearly when retailers were buying calls like crazy, OEX option traders, who historically proven to be always on the right side of the market, were on the bear side, so again, I don’t think a 290+ ISEE Equities Only Index readings are bullish.

INTERMEDIATE-TERM: BULLISH IN 3 TO 6 MONTHS

Combine the study mentioned in 02/23 Market Recap and 03/11 Market Recap, I still believe that 02/18 high will be revisited.

SEASONALITY: BEARISH 03/31, BULLISH 04/01

According to Stock Trader’s Almanac:

- Last trading day of March, Dow down 11 of last 16, Russell 2000 up 12 of last 16.

- Frist trading day in April, Dow up 13 of last 16.

See Friday’s After Bell Quick Summary for seasonality chart for the last 2 and the 1st trading days of the month.

For March seasonality chart please refer to 03/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ&Weekly | DOWN | |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | |

| EEM & Weekly | UP | |

| XIU & Weekly | UP | *TOADV MA(10) is way too high. |

| TLT & Weekly | UP | |

| FXE & Weekly | UP | |

| GLD & Weekly | UP | |

| GDX & Weekly | 03/23 L | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | DOWN | |

| IYR & Weekly | UP | |

| XLB & Weekly | UP | |

| DBA & Weekly | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.