SHORT-TERM: IN WAIT AND SEE MODE

Clueless about the short-term direction (as always), temporarily bearish biased, the excuse is statistics and seasonality are not bull friendly the next week:

- The statistics mentioned in 06/03 Market Outlook, weekly IWM Bearish Engulfing and SPX down 5 consecutive weeks means unpleasant the next week.

- According to Stock Trader’s Almanac, week after June Triple Witching, Dow down 11 in a row and 18 of last 20, average loss since 1990, 1.2%.

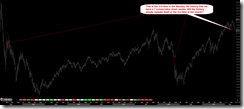

Chart pattern wise, after tossed a coin, I decided that the the 3rd push down (see 06/17 Trading Signals) has not completed yet. Although, lower low is not the must for the 3rd push therefore the Friday’s intraday pullback could be counted as the final push down, but see another chart below, looks to me the rebound is the weakest of all recently, so there’s a little little little little (insert another 100 little here) edges that the 3rd push down might not be over yet.

Nothing new to say. Normalized CPCE might have made a new history while Net % of all Sentimentrader’s Indicators at Extreme yells that huge number of Sentimentrader indicators are arguing on the upside, however, historically, it’s not so pleasant after QQQ being down 7 consecutive weeks, although we could always ask: will the 3rd time be different? All in all, I won’t be surprised that the market keeps going up the next week, but whether the low was in, we’ll have to wait and see.

INTERMEDIATE-TERM: STATISTICALLY BEARISH FOR THE NEXT WEEK

See 06/03 Market Outlook for more details.

SEASONALITY: BEARISH NEXT WEEK

According to Stock Trader’s Almanac, week after June Triple Witching, Dow down 11 in a row and 18 of last 20, average loss since 1990, 1.2%.

Also see 06/01 Market Outlook for June day to day seasonality.

ACTIVE BULLISH SIGNALS:

- 8.1.5 Normalized CPCE: Too high, so bottomed?

- 06/17 Market Outlook: Net % of all Sentimentrader’s Indicators at Extreme is very bullish.

ACTIVE BEARISH SIGNALS:

- N/A

ACTIVE BULLISH OUTLOOKS:

- 09/27 Market Recap: 9 POMO within 20 trading days means 14%+ up in 3 months.

06/10 Market Outlook: 75% to 81% chances a green next week.

ACTIVE BEARISH OUTLOOKS:

- 06/03 Market Outlook: IWM weekly Bearish Engulfing and SPY down 5 consecutive weeks were bearish for the next 3 weeks.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST:

|

||||||||||||||||||||||||||||||||||||||||||||||||

|