SHORT-TERM: COULD SEE SOME WEAKNESS AHEAD

Could see more pullbacks ahead, at least short-term, may not start from tomorrow though. My guess is the 07/18 lows will at least be revisited, either with higher low or lower low. An important bottom usually has 2 legs to be stable, so the 07/18 bottom still looks missing one leg, if indeed it was the bottom.

Listed below are all the major reasons why I expect more pullbacks ahead.

- A Bearish Reversal Bar formed on the SPY daily chart, the chart below should be clear that in most cases (red arrows are far more than blue arrows) it means at least a few days pullback ahead.

- ISEE Indices & ETFs Only Index closed at 182 today (retailers are extremely bullish), short at close today and hold until the very first red day since the inception of ISEE Indices & ETFs Only Index in 2005, you have 73% chances.

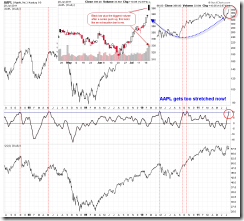

- The MACD of AAPL daily chart is way too extreme, see dashed red lines, it should mean pullback on AAPL and therefore QQQ ahead. Besides the AAPL daily bar today looks a lot like an exhaustion bar, so chances are that AAPL is topped or very close.

- As mentioned in 07/19 Market Outlook, SPY up 1.6%+ but NYSE Up Volume : Down Volume < 6, the following week was a little bearish biased.

- As mentioned in 07/18 Market Outlook, 2 Major Distribution Day within 5 days means short-term rebound (indeed) then 11 out of 13 chances more selling thereafter.

INTERMEDIATE-TERM: BULLISH JULY

See 07/01 Market Outlook and 07/05 Market Outlook for more details.

SEASONALITY: BEARISH NEXT WEEK

According to Stock Trader’s Almanac, week after July expiration, Dow down 7 of last 12, 2007 –4.2%, 2008 –4.3%, but up 4.0% in 2009.

Also see 07/01 Market Outlook for July seasonality chart

ACTIVE BULLISH OUTLOOKS:

- 09/27 Market Recap: 9 POMO within 20 trading days means 14%+ up in 3 months.

- 07/01 Market Outlook: Bullish July. Also one more evidence in 07/05 Market Outlook.

- 07/07 Market Outlook: New NYHGH high means SPX higher high ahead.

ACTIVE BEARISH OUTLOOKS:

- 07/20 Market Outlook: Multiple evidences arguing for more pullbacks ahead.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|