SHORT-TERM: COULD PULLBACK TOMORROW, BUT HIGHER HIGH AHEAD

The market has chosen to go Bear Flag or Rising Wedge, so let’s see if it could decisively breakout the green line in the chart below.

Two conclusions:

- Most likely red tomorrow.

- More up ahead especially if red tomorrow without higher high first.

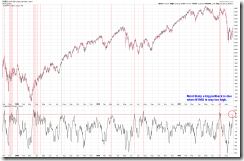

The chart below should prove why most likely a red tomorrow: NYMO is way too high, there’s only 1 exception in the chart the next day was green.

Tow charts below are arguing more up ahead. They basically are the law of inertia, a strong push up like we had in the past 2 days seldom fail right away.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook for more details.

SEASONALITY: BEARISH TUESDAY, BULLISH THURSDAY

According to Stock Trader’s Almanac:

- August’s next-to-last trading day, S&P up only twice in last 14 years.

- First trading day in September, S&P up 11 of last 15, back-to-back huge gains 1997 and 1998, up 3.1% and 3.9%.

Also please see 07/29 Market Outlook for day to day August seasonality chart.

ACTIVE BULLISH OUTLOOKS:

- N/A

ACTIVE BEARISH OUTLOOKS:

- N/A

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|