SHORT-TERM: WE MIGHT HAVE ONLY ONE DOWN DAY UNTIL FOMC

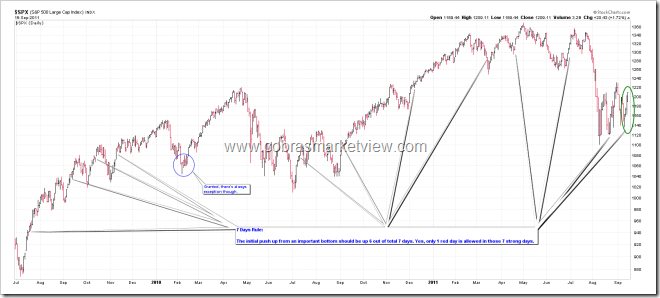

The big picture, because SPX didn’t exceed the height of the tinted area, within the time represented by the width of the tinted area, so again it proves the rebound is weaker than the previous 2 times (a > a’, b < b’, time spent on B < time spent on C), therefore I’ll maintain my view that what we have so far is just a rebound. The chart below is my most updated evil plan. The main idea is:

- This is a 3 push up rebound.

- The last push up should be the weakest (as I’ve been trying to prove in all my recent reports).

- If however the red line is decisively broken, then pretty much bears are dead meat again.

The chart below explains why I made a little modification on the above evil plan today. Because I’ve noticed an interesting thing that a strong rebound from an important bottom usually lasts 7 days, with only 1 red day at most. So far the market has been up for 4 days, plus 3 days and allowing 1 to 2 days differences, it happens to be around Sep 21 FOMC. So my conclusion for the short term:

- At least will be up to Sep 21 FOMC.

- During this up period, there could be just 1 red day at most. (What if there’re more than 1 red days? Well, simple, it only proves my view that this is just a rebound, doesn’t it?)

- Target SPX 1230, because B = C (see evil plan chart above).

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook for details.

SEASONALITY: BULLISH FRIDAY

According Stock Trader’s Almanac, September Triple Witching, Dow up 6 straight and 7 of last 8.

See 09/02 Market Outlook for September seasonality.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

|

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|