SHORT-TERM: STATISTICALLY BEARISH FOR THE NEXT COUPLE OF DAYS, BUT I’M NOT SURE

First of all, my apology to ID “valunvstr”. He sent me a message explaining what happened yesterday was a misunderstanding. I think I own him an apology that I mistakenly thought he was someone else. I hope my formal apology could clear his name and make him come back to comment more. And my sincere thanks for those who stood behind me yesterday, really really appreciate.

I have 3 more signals suggesting not very pleasant tomorrow or the day after tomorrow, plus all the statistics mentioned in 10/04 Market Outlook, looks like odds are high that tomorrow or the day after tomorrow wouldn’t be pleasant. However, frankly, at the current stage, I have no confidences in those signals. Because:

- The rebound from an important bottom, usually lasts at least 7 days, up 6 out of 7 (so called 7 days rule), during which period, nothing bearish would ever work.

- The very unique thing yesterday and today are astonishingly similar to Sep 12 and Sep 13. As the later day rally statistics mentioned yesterday is exactly the same as in 09/12 Market Recap and the statistics about ISEE Indices & ETFs Only Index, I’d mention later today, is also exactly the same as in 09/13 Market Recap, so I’m afraid that we might repeat what happened from Sep 12 to Sep 16, in another word is, the market would be up every day until the next Monday (which happens to be the very first Q4 ER report, coincidence?).

- From the chart below we can see, the rebound happened from Sep 12 to Sep 16 was repeated exactly from Sep 22 to Sep 27, in terms size and time, so according to Measured Move, at least the rebound this time would equal to the previous 2 times in terms of time and size. Personally, I believe it could be even stronger.

All the above are, of course, speculation only, with no solid evidence, so theoretically we should believe only those statistics and signals, which are more objective, that tomorrow or the day after tomorrow would be unpleasant. Just personally, I have no confidences in such a so called objective conclusion. The reason I sounds reluctant in calling bear is because now the short-term trend is clear up, so against trend signals are hardly reliable, I don’t want you guys to be too bearish simply because of my report. The report itself, however, must be objective, so I cannot pretend that I don’t see something therefore refuse to draw any conclusion that I don’t want to believe. But I can still tell you that sentimentally I might have no confidence. All in all, the goal is to be unbiased but still balanced for those inexperienced traders, hope you all could understand.

Now let’s take a look at those so called objective signals:

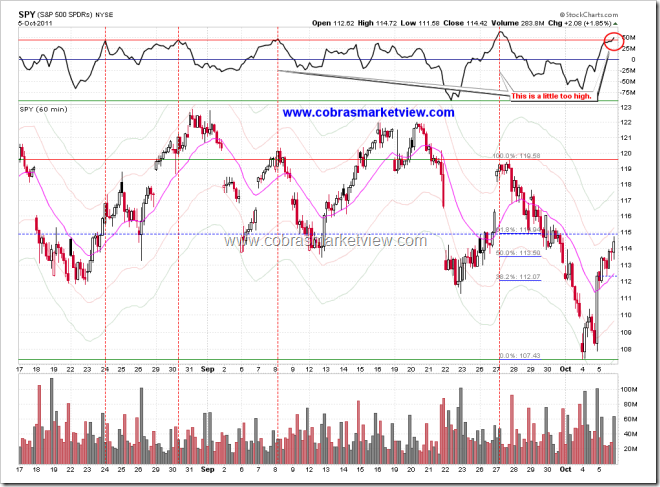

ChiOsc is a little too high.

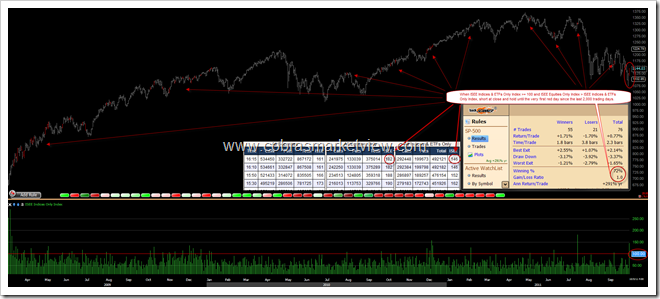

ISEE Indices & ETFs Only Index >= 100, from the statistics below, 72% chances, no later than Friday, everything we gain today and tomorrow would be totally erased. This statistics, as I mentioned above, is exactly the same as I mentioned in the 09/13 Market Recap (that didn’t work at all the last time).

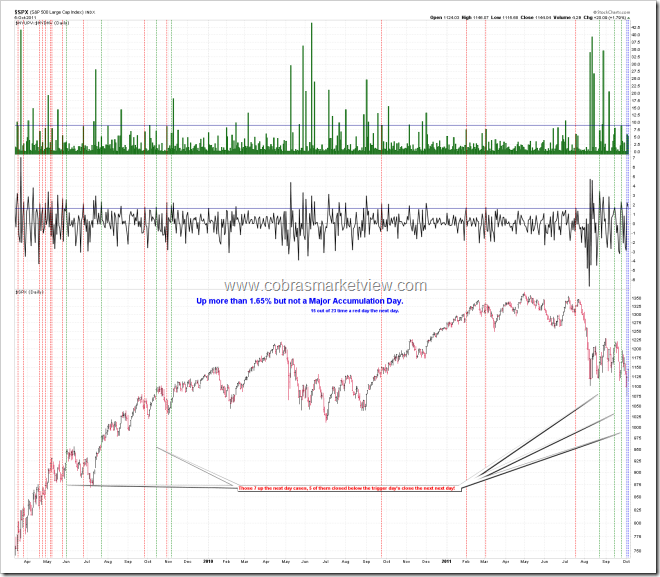

Today, again, another 1.65%+ rise but still not a Major Accumulation Day, so statistically, short at today’s close, 90% chances bears would win something within 2 days. In fact, since I mentioned the same chart yesterday, so accordingly, if yesterday’s 90% chance still works, all today’s gain should be completely erased by tomorrow.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BEARISH MONDAY, BULLISH OCTOBER AND 4TH QUARTER

See 09/30 Market Outlook for details. The outlook also includes the October day to day seasonality chart.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

|

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|