SHORT-TERM: HIGHER HIGH AHEAD

Nothing to say, at least there’ll be one more push up, because rarely, if never, was a Major Accumulation Day exactly the market top.

Tomorrow is the famous monthly Non Farm Payroll day. The intraday pattern is open high go lower or open low go higher. The chart below shows all the Non Farm Payroll days since the year 2009 bull market, looks like the chances for bulls and bears are 50 to 50 tomorrow, although 4 consecutive reds recently.

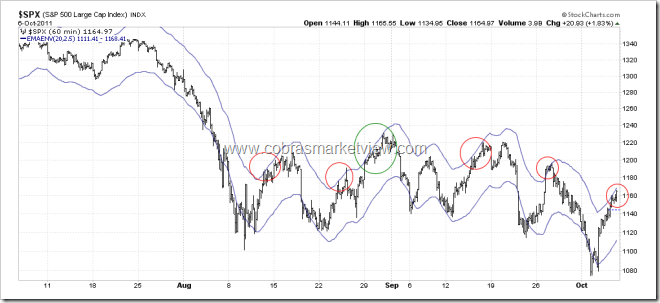

A little speculation about tomorrow’s open: Because of the gravity, there’s a limit on how far a price can move away from MA. For SPX 60 min chart, EMA ENV(20, 2.5) seems the up limit. Today it closed almost on the limit, so if huge gap up open tomorrow, it’d be out of the limit therefore whether such a gap could hold is questionable, especially we all know that the typical Non Farm Payroll intraday pattern is open high go lower or open low go higher.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BEARISH MONDAY, BULLISH OCTOBER AND 4TH QUARTER

See 09/30 Market Outlook for details. The outlook also includes the October day to day seasonality chart.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

|

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|