SHORT-TERM: MORE LIKELY TODAY’S HIGH IS NOT THE HIGH

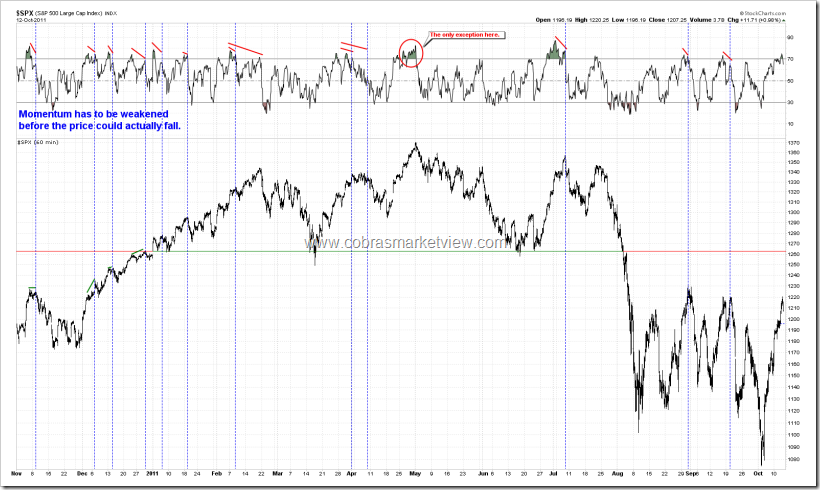

The market showed a very strong up momentum today, so whether there’ll be a pullback or not tomorrow is not important anymore. What really matters is, the pullback if any, more likely is buy because more highs ahead. The reason still is (my famous) “an forward accelerating car cannot be reversed without slowing down first”. Such a forward acceleration can be witnessed by the RSI overbought and new high made today, therefore at least one negative divergence is needed to prove the up momentum is weakening hence some chances of reversal thereafter. In another word is that there must be a new high on price but not RSI first, otherwise it’s not a negative divergence, then we’ll have to wait for the next price new high while RSI fails to reach a new high, such a game can go on and on, the key is the momentum must be weakened first.

INDU made a higher high today, also implies that SPX will have a new high.

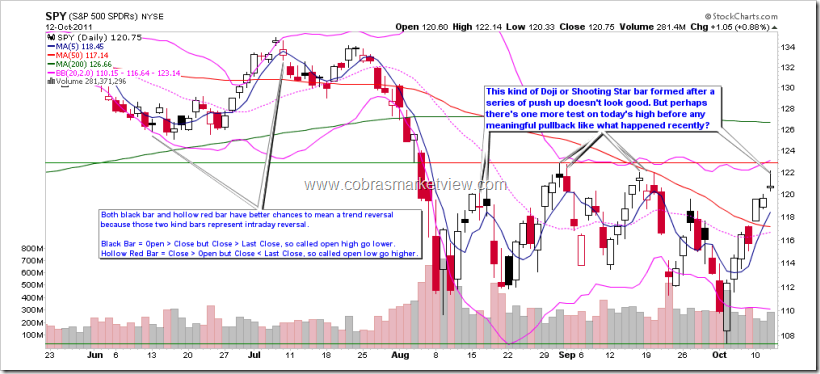

I’m sure people would point out that the candlestick pattern is ugly today which is a Doji or Shooting Star. Yes, that’s right, but if you read the chart carefully, for all such a candlestick recently, the highs got revisited first before any meaningful pullback. So combining with the evidences I provided above, there’re some chances that SPY may revisit today’s high tomorrow (making a new high so as to let RSI form a negative divergence), and if on such a revisit, however, SPY fails to make a decisive breakout again, then the real pullback could begin.

So to summarize above, the trading strategy could be like this:

- Drop at open without higher high first, then it’s a buy because there’s no RSI negative divergence.

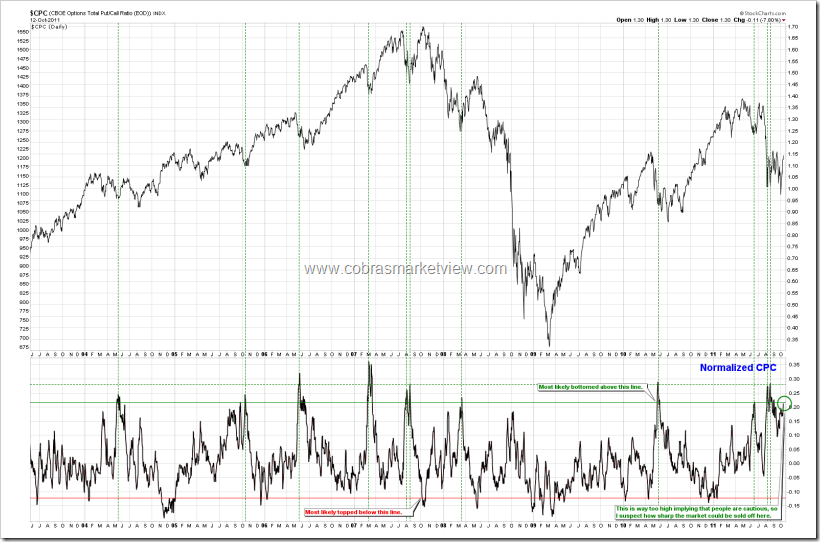

- Making a new high first but fails again to breakout decisively, then be careful of the pullback which is long overdue. Such a pullback, however, I believe won’t be too much (which conforms the Route A, I reiterated in the yesterday’s report), therefore could also be a buy opportunity. The chart below should prove why the pullback, if any, won’t go too far, because Normalized CPC is way too high, implying big guys are already well hedged (prepared).

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: NO UPDATE

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: MORE LIKELY TODAY’S HIGH IS NOT THE HIGH

今天的上涨说明上涨动力很强,因此明天有没有pullback已经不再重要,重要的是,pullback如果有的话,多半是buy,因为还没有涨完。理由还是向前加速的车不经过减速是不可能突然倒退的,这个向前加速表现在RSI上就是overbought and new high,这样,就至少需要一个negative divergence才可能减速,然后才有倒退的希望。这就是说,price多半还有new high,否则是不可能和RSI构成negative divergence的。

INDU今天率先higher high了,也是说明SPX会有new high。

有同学会指出,今天的棒棒很难看,是个Doji or Shooting Star,不错,但是仔细看,前几次SPY在形成类似今天难看的棒棒后,都有个回测前高的动作,结合上面的证据,因此不能排除明天回测今天的high的可能性,如果届时,还是不能有decisive breakout的话,那就真的开始回调了。

综上所述,交易策略:

- 明天开盘就跌,那比较确定是买,因为RSI没有negative divergence。

- 明天先新高,但不能decisive breakout,就要小心回调,但这个回调,我认为多半跌不到哪里去(跟我昨天的报告里重申的Route A是一致的),因此可能也是买。下面的图可以证明这个回调,如果有的话,多半跌不到哪里去,因为Normalized CPC太高,大户们早就hedge好了,就等着你来砸盘呢,嘿嘿。

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: NO UPDATE

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

if assume s&p range of 25-30 handles each day then dip can be deep and more likely today’s high not visited tomorrow even if we rally off low. we can see 1180 before 1200+. 1180 is not a small pullback

Thank you as always.

I think we should buy the f**king dip again. LOL.

Very appreciated with your hard working, a masterpiece !

I think the rebounce should have two ways.

One is a bullish flag and head to 1230+ to 1250+ ; another is zig-zag, ABC pattern, hit 1250+ .

This is maybe a prelude of Halloween Party. YMYD.

Cobra, thanks.

My daily homework is to read your market outlook. learn and practice.

Thanks.

Hi Cobra, for the chart of CPC value, I have a different view. From the chart, we can see the local high CPC is always related to a local low on spx, so if CPC high appears in a downtrend, one may expect the lown is close. However, today is too much from a local low. So the only explaination is from now on we may have a considerable drop and a higher CPC until a new local low is formed.

Make sense, but from the entire history, Normalized CPC cannot rise forever because Normalize means MACD(10, 200, 1), i.e. EMA10 cannot too far above EMA200, that’s the gravity, no one on Earth can be above that. So I agree that normalized CPC could rise more but there’ll be a limit and we’re pretty close.

cobra, thank you very much. i am also following silicon_beaver’s path 😀

New post

http://thethoughtfultrader.blogspot.com/

thanks!

THX!!!

thanks

I feel we can possibly have one more up move to around 1220 (+/- a few) at most then a down move to around 1160. Just my opinion.

Thanks Cobra. Good analysis and completely agreed. Whatever pullback or consolidation that manifests in the short term should be bought. I am seeing more upside for the next few weeks (and likely months, IMO): http://marketthoughtsandanalysis.blogspot.com/2011/10/oct-12.html . Thanks for your work!

Cobra, trad P&Fs say 1200 is new basis and 1st target is 1230 – this fits your forecast!

Thanks Uempel, have a good time. We’ll be missing you.

here’s a good read on a contrary indicator (put/call ratios as well are historically high).

http://www.marketwatch.com/story/good-news-wall-streets-in-a-bad-mood-2011-10-12?siteid=rss&utm_source=tf

i noticed that today as well. the put-call ratio is still as high as it was last month (and as high as Oct 08!). there are way too many hedged positions or bears (or both) out there right now. as the article says, that is contrarian bullish. sentiment can shift quickly though, and so can put-call ratios; however, pullbacks should be bought for the next month at least.

http://www.indexindicators.com/charts/sp500-vs-put-call-ratio-total-1d-sma-params-3y-x-x-10ma/

want to to make some quick short trades during the impending abc correction.

roadmap for thurs. is available for anyone interested, click on my name for the link.

Zweig Breadth Thrust may have occurred today as it ended at exactly 61.5%. It has two days to exceed the 61.5% level to “officially” signal, and if it does, it’ll be the 3rd time in the last 27 years. The others were March 2009 (stock market low!) and Aug 1984.

This is potentially a very bullish sign.

Zweig Thrust only means significant higher in 18 months, I remember. I don’t trade that long. Snakes are short sighted. 🙂

Opex is coming so it would make sense for a turn lower in to Opex post employment…. while technically we are quite different, a parallel structure would be April 2011 (Major fall and rally prior to April employment, rally post employment, top on the Wednesday post employment and then a rollover in to Opex… with a bottom Thursday, a bounce and then a final fall in to Monday before a decent rally!)

I also like the fact that it is earnings season both times.

-D

S&P next week 1165!!!

look chart.

http://mcclinbeursanalyse.blogspot.com/p/opvallende-partoon-grafieken.html