SHORT-TERM: COULD SEE MORE PULLBACK, A REMINDER OF USUAL AAPL POST ER PATTERN

Three cents:

- Could see more pullbacks ahead. However, there’re some chances the market sell off in the morning but rebound to close in green eventually.

- Temporarily maintain the call that the pullback is a buy opportunity. However, besides the experiences, I don’t have any solid evidences to support such a judgement. And unfortunately, I also don’t know if there’s any good way to know, as early as possible, whether the rebound since the Oct 4th was over or it is a buyable dip, so I’m afraid the report for the following days may just be a guess game. Basically:

- As long as we don’t see 3 consecutive down days then the trend is clearly up, because a strong uptrend should never have 3 consecutive down days. That said, even we do see 3 consecutive down days, it doesn’t prove that the rebound was over, it only argues that so far we had is just a rebound that my dream yacht would have to wait longer before possible.

- The rebound since the Oct 4th is very strong so it’s really rare such a rebound is just one legged, therefore at minimum the Friday’s high shall be revisited, which already is the worst case mention in the 10/14 Market Outlook after a Selling Climax.

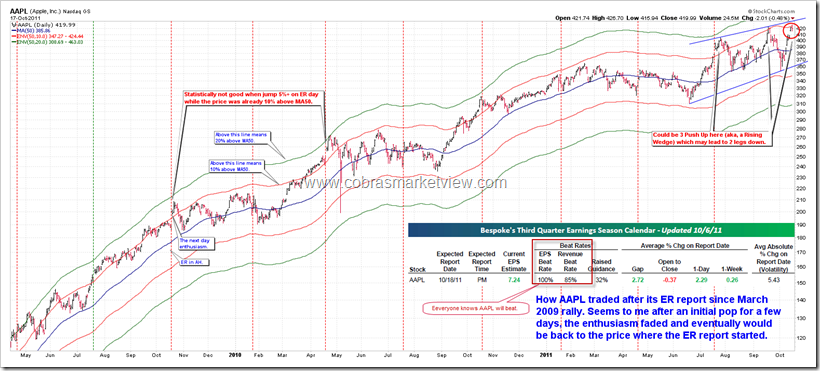

- AAPL ER in AH tomorrow, I just want to remind you the usual AAPL post ER pattern is fireworks that it skyrockets high then falls back to the ground in a few days.

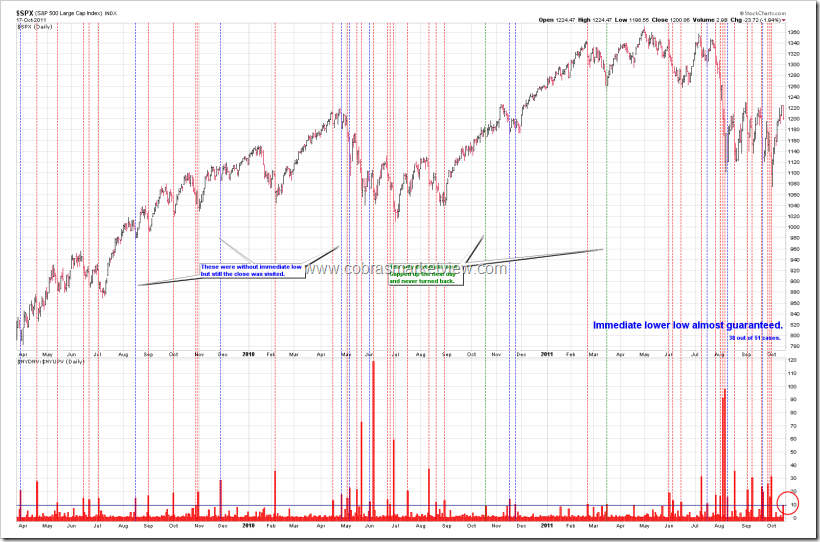

Why could see more pullbacks ahead? Because today is a Major Distribution Day, which in another word is, for such a strong down momentum, it’s rarely just one day’s event.

Why could the market eventually close in green tomorrow? Because although SPX dropped 1.9%+, but TICK closed above 0, statistically, it seems bulls have a little edges tomorrow. Well, 81% chances are not “a little edges” but using SPY to do the back test would have totally different story which implies the green or red close might be just a cent or two differences for SPY relative to today’s close.

The chart below clearly demonstrates the usual AAPL post ER fireworks. In addition a 3 Push Up pattern could be in the forming, which if indeed, may imply the pullback may not be small.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BULLISH MONDAY, BEARISH FRIDAY

According to Stock Trader’s Almanac:

- Monday before October expiration, Dow up 25 of 30.

- October expiration day, Dow down 5 straight and 6 of last 7.

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: COULD SEE MORE PULLBACK, A REMINDER OF USUAL AAPL POST ER PATTERN

三点说明:

- 应该还没有跌完,不过,不排除明天早盘跌,但是尾盘拉起收绿的可能。

- 暂时维持pullback是买的结论。关于这一点,我没有什么证据,纯粹是经验。很遗憾,我也不知道有什么方法可以尽早的判断出来,自10月4号以来的反弹已经结束了,还是这仅仅是个buyable dip,所以后面只能连猜带蒙。基本上:

- 只要不连跌3天,那么上升趋势就没有问题,因为一个强上升趋势是不会出现连跌3天的情况的。当然,既使连跌3天,也不能说明反弹结束了,只是证明这仅仅是个反弹,我那艘梦中的yacht可能暂时就不要想了。

- 10月4号以来的反弹非常强,只有一条腿就结束,是非常非常少见的情况,因此周五的high至少还会去一下的,这个已经是在10/14 Market Outlook里提到的Selling Climax最坏的情况了。

- 明天盘后AAPL ER,注意AAPL post ER通常是放焰火,冲上去,然后过几天又会掉下来。

为什么说还没有跌完?因为今天是Major Distribution Day,换句话说,这么大的下跌动能,不可能一天就到底了。

为什么不能排除明天尾盘拉起收绿的可能?因为今天虽然SPX跌了1.9%,但是TICK却收在0以上,统计上看,明天牛牛还是有一点点edge的。81%不是一点点edge,之所以这么说是因为用SPY测试就没有这么明显的edge了,这说明可能明天收绿或者收红仅仅是SPY一到两分钱的差别,不会大红大绿。

下面的图应该充分说明AAPL ER后放焰火的情况了。此外,图上看,有3 Push Up的可能,如果是真的话,此后的pullback不会小。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BULLISH MONDAY, BEARISH FRIDAY

According to Stock Trader’s Almanac:

- Monday before October expiration, Dow up 25 of 30.

- October expiration day, Dow down 5 straight and 6 of last 7.

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Cobra, do you consider this a buy signal now ?? http://stockcharts.com/h-sc/ui?s=$NYSI&p=W&b=5&g=0&id=p83223631152

No for 2 reasons:

1. Not Friday yet.

2. The long term signal is sell, so only NYSI Weekly STO sell is valid. This is very important factor.

Thanks for sharing. I agree the pullback isn’t over yet. The

disappointment caused by IBM’s earnings will bring the market further

down. Think about what stocks were holding up the index!

Today TNA closed down 9.5%. It has done so 37 times since its inception. Here are the STAT for its performance the next day

Close to Next day high: positive 33 times

Close to next day low: negative 31 times (one could have used this info to buy TZA)

Close to next day close: positive 22 times(59%)

So based on this, the odds of a green day tomorrow are 59%, but more pain is almost guaranteed before seeing a green EOD.

Happy trading!

Thanks. Although I don’t quite understand what is “close to next day low” and “negative 31 times”…

It mean 31 times TNA traded lower (relative to close of losing day) next day . It may not mean anything for a long trade but gives a sense of what to expect next day. Actually the dips next day are substantial, averaging 6.5% (Range ~0.4-13.9%)

Thanks.

yikes, with 37 instances one cannot simply add up the lower lows and higher closes following day and say “these are the odds”

not even close, 37 instances doesn’t statistically qualify as anything but noise

sorry, it’s just math….

thx, ding

thanks!

Did an update on end of day to add to your analysis. KEEP AN EYE ON THAT U.S. dollar!

http://heavenskrowinvestments.blogspot.com/2011/10/101711.html

Honestly, I really did not understand why lots of traders prefer TNA, TZA, FAS, FAZ etc.

For the DT is not a big deal, but for the ST, more than 2 days, it is horrible.

Time decay on these 2x or 3x ETN is unavoidable.

u’ve got a point there. what would u recommend then for a swing-trader? I don’t mind holding my ETF from 3 to 10 days (or even more in the periods of bernanke put)..

you get better mileage out of a well chosen option on any of the non-levered indexes, or a proxy for one of those sub-sectors.

Thanks Jarbo. Could u pls give some example names for the proxies, or the non-leveraged indexes? I haven’t done options before; but am very much interested. Thx!

THX!!!

Cobra,

As always, opex week is meant to confuse and frustrate the most people – it is also ALMOST ALWAYS a turning point! (Turning point can occur from Tues of opex week to the Tuesday after, with a few rare instances of the Wed after…) The turn can be countertrend or it can be a return to the primary trend…. one never knows….. but in the case of this Opex…. the configuration going in to opex (and even now), most closely resembles opex periods where we put in a low the week after opex or on opex week.

While there are significant differences, April 2011, is a good example of the type of opex week we might experience with the low for the week being Thursday – then a strong 2 day bounce with the final low for opex being on the Monday after…. There are many more examples from opex periods where we had strong weekly up momentum, but had turned down from the Thursday before after a good rally…..

All those weeks after that setup had almost always had lows of the week between Wed and Fri and formed some sort of bottom as the opex turning point.

THANKS!

-D

Thanks. As of today’s close, seems this OE week is forming a top of some kind.

thanks cobra laoda