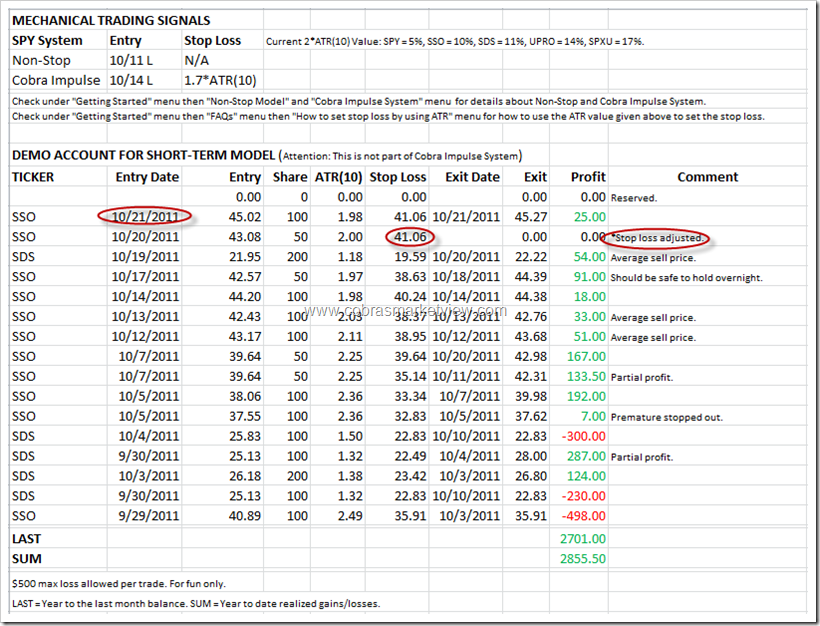

SHORT-TERM MODEL BELIEVES THE TREND IS UP, HOLDING LONG POSITION OVER THE WEEKEND

The bottom line, bears still have hopes as long as no follow through big up the next Monday. Will explain in the weekend report. Sorry for the wrong closing statement for today’s intraday comment thread, I said new high the next Monday, I thought it were Major Accumulation Day but it’s not, so forget about that closing statement. I don’t mean we won’t see new high, I just have no solid evidence for such a call anymore since today is not Major Accumulation Day.

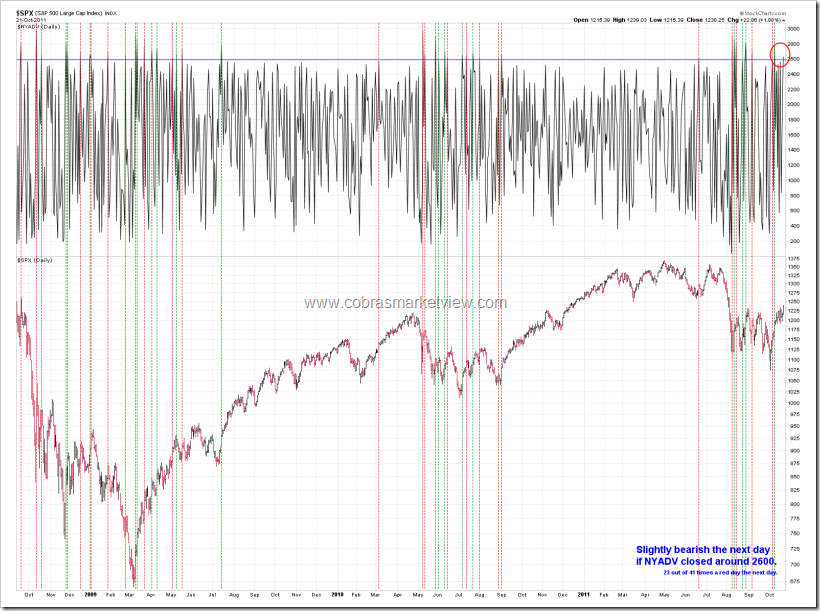

Just a little little bearish biased toward the next Monday because NYADV is a little too high.

Enjoy your weekend!

Thanks Cobra! Have a fantastic weekend!

Thanks.

btw, no need to say sorry. it’s our individual decision. 😛

nice weekend,

I was thinking that was right where the market would settle: right where the bulls are still not jumping in head first for caution’s sake, and the bears still have the hope of seeing an outside reversal (or at least a bearish engulfing) on Monday.

Right at the peak in the roof of that chart uempel posted intraday. http://bbs.cobrasmarketview.com/download/file.php?id=9016&mode=view

. . . but the bulls haven’t fumbled yet . . .

Haven’t updated this in awhile, but as of Wednesday, Cobra has been eliminated from the competition. The dow is 1,000 pts away from a new high, and managed to rise 1,400 pts in 14 trading sessions, so at least the Dow shouldn’t have too much difficulty pushing to a new high by the end of the year, although I’m sort of in the bearish short term camp now myself expecting a retracement.

The Dow has busted past the resistance formed in March whereas the S&P has not, so a close above 1260 or so is guaranteed for the S&P.

Indeed, those who thought they could flame and outplay Ben Bernanke, have been defeated.

Cobra vs Ben Bernanke Contest

Current S&P Close: 1238

Cobra’s Level: 1000

Predicted By: 10/19/2011

Status: Eliminated

Ben B’s Level: 1380

Predicted By: 12/31/2011

Points Remaining: 142

Days Remaining: 48

Pts needed per day: 2.95

When the pts needed per day goes above 10 I would consider it an impossibility. The rise actually hasn’t been strong enough to suggest that it’s a sure thing. I think it’s guaranteed in the long run over the next year, but the end of the year seems a little aggressive now. We’ll see how deep the retracement is.

Already hedging your bets? Now you’re opening the window out to 1 year from now. Does Cobra get to open his window out to 1 year as well?

Until we can clear 1260, I am not totally sold.

MEDIUM TERM

———————–

Each time the ECRI calls a recession, it is the beginning of a bear market rally. See charts for striking similarities between S&P action and ECRI recession calls.

I have been wrong in my recent near-term bearish pullback to 50% retrace calls (which were based on similarities to past bear market rallies), but the medium term expectation for 200 day MA visit still looks probable.

Very good charts thanks!

Smart observation!

Cobra : I m bearish, but situation is its keeps going( wave 3 of 5 from 1075), we might be back to 1320+ around christmas or early Jan before it comes down in Feb12. What is your view?

We might see pullback the next week, then we’ll see. I think the 1st up leg from the Oct 4th low is almost near an end.

My first post here – Cobra, i have been following your analysis for almost 3 months and thank you for your GREAT analysis everyday. Being a novice trader i enjoy your comment (with solid evidence) and also learn a lot from you and everyone who contributed.

Back to the market, my long term view is bullish from here to next year with Thanksgiving and xmas are on the way besides, presidential election will be next year so Ben and Obama will be doing everything to save the world (my two cents) short term view bearish as it is way too stretched at the moment, so far we don’t see a significant pullback since with Oct 4. Besides, Apple is lagging in this rally and also FX is toppy, so think the correction is close but don’t really know how big this is.

Anyway, the above only my two cent :D, have a good weekend everyone.

Thanks. I agree with short-term pullback and bullish intermediate-term but I kind have doubt about rising to the year end. Maybe some dip in November before the year end rally, otherwise this market would be at all time high at Christmas time. 🙂

Weekend Report

http://thethoughtfultrader.blogspot.com/2011/10/weekend-report_22.html

Comments on the chart.

http://img845.imageshack.us/img845/4273/spx211011.jpg

THX!!!

BPNYA +6.95%, BPCOMPQ +3.40%, BPOEX + 8.57%, BPSPX +8.93%, BPNDX +3.45% and BPINDU +10.53%. BPSPX chart shows that the bullish move has further to go, but not necessarily next week:

A look back at 2008 suggests that BPSPX (and of course SPX) has further upside until December. Chart is a bit messy, but the main message seems clear: Friday’s high ain’t the final top of the strong rebound from 1075.