SHORT-TERM: EXPECT PULLBACK AS EARLY AS TOMORROW

Simple today, one word: Overbought!

Those who followed me for awhile should know, rarely I used the word overbought as title. If indeed, then it must be extremely extreme, therefore always a red day the next day. This time, however, let’s prepare for the exceptional exception, so, say, Wednesday would be the short-term top, while I certainly don’t expect huge up in the coming Tuesday and Wednesday. If interested, either you can search all my past reports by using overbought as key word or pay a little attention to this site’s new feature that the most related 5 topics will be listed at the end of every report (so this means you must skip the Chinese translation, jump to the real end of the report before the comment area), where generally the past reports with similar title will most likely be listed which I think should save you some time to do the search.

The last but not the least, let me make this very very clear again: Nowadays the market tends to go extremely extremely extremely extremely extreme before any reversal is possible, so you should beware that shorting now is very very very very dangerous, therefore is for aggressive traders only.

Now let me present my witness, why the market is overbought.

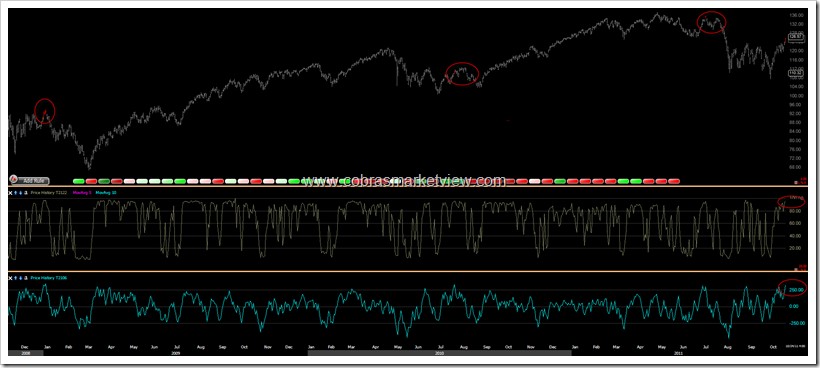

Actually I’ve already mentioned them in the 10/21 Market Outlook. Today’s huge up was enough to make my two ultimate weapons for watching overbought, NYMO and T2122, go extreme. Between them, as I mentioned before, NYMO is among those very rare signals that cannot be argued. Below are what NYMO and T2122 look like today. Since T2122 might not be extreme enough, so that’s why I didn’t say absolutely a pullback tomorrow (well, never did I say anything absolute), instead, I give bulls 2 more extra days (at the most).

The chart below combines NYMO and T2122 together. Highlighted in red, are the only 3 cases in the past 10 years when both reached an extreme level at the same time. Among them, indeed there’s a case the market rose for another 2 days and this why I kept saying above that I’d allow 2 extra bullish days until the Wednesday.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: EXPECT PULLBACK AS EARLY AS TOMORROW

今天很简单,就一个词,超买了。老读者都知道,我不轻易用overbought作标题,如果用的话,一定是extremely extreme了,因此基本上第二天都会有pullback。就算我们这次是例外中的例外吧,那么最迟周三是top,而周二和周三大涨特涨的可能性并不大。有兴趣的话可以search我过去用overbought作标题的例子,或者使用本站的新功能,现在每篇报告的最后都会有related topic,一般标题类似的会被优先列出,这样就省的查找过去的例子了。最后再次强调一下,现在的市场不论牛熊,经常是extremely extremely extreme才有可能反转,所以目前做空是非常危险的动作,因此是for aggressive traders only。

下面看看为什么我说超买的证据。

其实我在10/21 Market Outlook里已经提了,今天大涨,我的两个看overbought的终极武器,NYMO和T2122就会超买,其中NYMO是不能argue的。下面就是今天NYMO和T2122的情况。可能T2122还不够extreme,所以我才没有把话说死,放出了两天的余量。

下面的图是把NYMO和T2122合在一起,这两个同时都extreme的例子,整个10年就3个例子,见红色高亮部份,其中就有又长了两天的,这也是我为什么把余量放到周三的理由。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

cobra did the puts ( options ) bought buy the big institutions still up today ?

Yes, OEX put surged.

Not necessarily a bearish sign, but you know that…

cobra do you make more money if we click on those ads on top of the page . ?

Yes, please.

Is there a limit to how many times we can do it, or can we just keep clicking?

One machine can click different ad. If one machine on one ad many times, it count as only one time. What is different ads mean? As long as the content is different, it’s different.

thanks cobra. Good analysis and to the point !

As always, your work is much appreciated.

thx,ding

i clicked on some ads for you. thx cobra

Cobra, assuming the pullback happens tomorrow (the futures are pointing in that direction this evening), do you have a preferred scenario whereby we resume the multi-week rally? For example, do you expect the pullback to be brief, do you have a target, etc.?

Let’s see sharp pullback first, otherwise it’s still pretty much the 1st leg up.

thanks

tuesday roadmap for anyone interested.

click on my name for the link.

best performers in my s.t. high risk portfolio were

$ift, $stp and $cis up respectively 19.89%, 17.39% and up 11.51%.

all in the roadmap.

1250 ES = heavy resistance

thanks!

Always thank you for your insight. May I ask your opinion or target of VXX this time? I just got stuck in there and am looking for exit. =(

Always thank you for your insight. May I ask your opinion or target of

VXX this time? I just got stuck in there and am looking for exit. =(

Let’s say, 47.5 or 50 are possible.

Thanks Cobra.

was busy daytime. working on this homework now.

Bullish percentages all up except BPINDU, which is flat. BPOEX up 2.63%, but BPNYA, BPSPX, BPCOMPQ, BPNDX are up roughly 10%. Chart shows BPSPX at or very near a short term top.

I tend to feel uneasy when bearish market action vanishes in a matter of days, reeks of engineering. SPX made 17% in 16 days. Presumably a few biggies decided to long October 3rd and that’s it, zillion diciples jumped in too. I’d love to know what the biggies are planning for the next few days. Any biggie reading Cobra’s comments? Pls show us your plan.

THX!!!

THX!!!

Does look like a post opex turning point – after Opex in 2009 we had a similar topping pattern (though not a huge surge on Opex Friday and Monday), but nevertheless, we did roll over with after Wednesday of that week.

Except for 1998 when the surge just went on and on, October opex is good for at least a small turning point, which would see us have at least a pullback if not a more significant top.

Bottom line – Cobra, the opex facts agree with you.

-D

This is interesting: weekly BPNYA chart looks much healthier than (daily) BPSPX, shows a more sedate bounce. Presumably many bulls bought spy, didn’t bother to buy individual equities. One thing is for sure: BPNYA chart shows no sign of weakness, none.

This is a work in progress.

Comments, feedback, ideas, recommended changes and additions, etc., are all welcome.

I think I need to move the 2008 and 2009 early buy and sell spike to the right to March and July 2009 respectively.

thanks cobra laoda

worst performer today in the s.t. high risk portfolio was $stxs -7.55%.

best performer today in the s.t. high risk portfolio was $spmd +12.54%

click on my name for the wednesday roadmap.

just finished watching a charlie rose interview with walter isaccson, the biographer for steve jobs. very worth while one’s time.

I give up. All reason has gone from this market. It’s so massively overbought now, that it’s embarrassing. Fundamentals are uniformly weak, no resolution in Europe. Markets can only go one way as investors realise they’ve bought dog-$hit for the flimsiest of reasons

Thanks. First I thought you’re emotional, then I realized you just book your profits. Congratulations!