SHORT-TERM: MAY SEE LOWER LOW AT LEAST TOMORROW INTRADAY

The chart below is my wild-est-est-est guess about the future. It should be a 2 legged down, which size should be larger than the previous 3, so tomorrow we could see lower low to complete the 1st leg down then a rebound of some kind. Such a rebound might not make a new high (chart only illustrates directions, I’m not sure the rebound size), then we’d see the 2nd down leg. In case the rebound made a new high, as long as it’s not decisively higher then still it’s 3 Push Up, the 2 leg down will be delayed for a few days which we’ll discuss later if indeed.

Now let me explain why I made such a wild-est-est-est guess.

Why will we see a lower low?

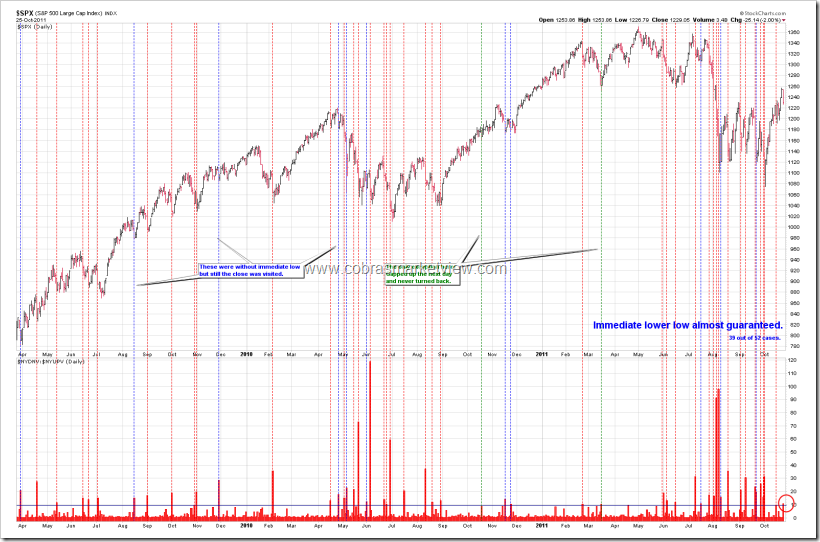

- The major reason is already given in the chart above: Pullback 1 < Pullback 2 < Pullback 3, so according to one of Cobra Laws, since the demand generally weakens while the market keeps climbing up so usually pullbacks get bigger and bigger, therefore accordingly the Pullback 4 should be larger than the Pullback 3.

- Today is a Major Distribution Day, which means 75% chances a lower low tomorrow. This actually is the law of inertia (Hmm, I’ve got so many laws, I just realized I’m kind like a lawyer now), as Major Distribution Day implies a strong down pressure therefore seldom just a single day drop.

Then why would a rebound, if indeed, eventually fail?

- Usually 2 leg down after 3 Push Up. I don’t know how to explain this, nowadays I introduce more and more pattern analysis which I would avoid in the past because it’s more based on experiences.

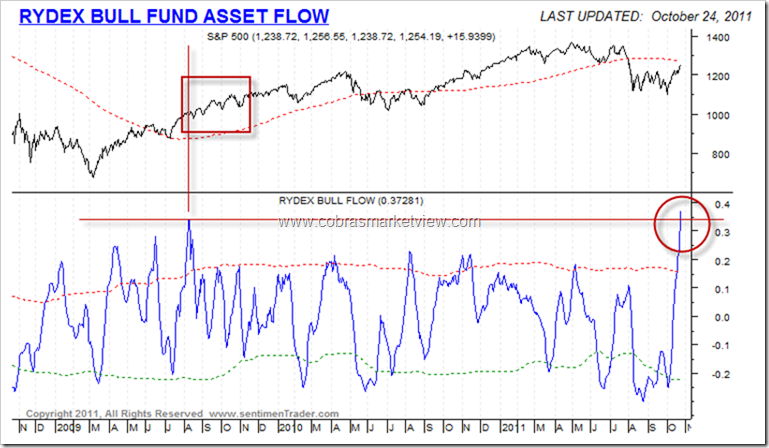

- Retailers are way too bullish. Rydex traders have accumulated huge amount of bullish fund which is even larger than that of July 2009, when the market began to seasaw up thereafter. My question is why we would go straight up from here this time? Anything unusually better than that of July 2009?

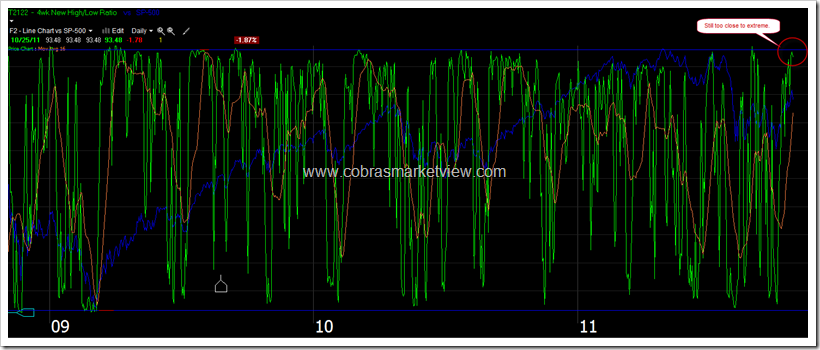

- The pullback may no be enough today because T2122 still is very close to an extreme level so a little bit large rebound would make it overbought again.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: MAY SEE LOWER LOW AT LEAST TOMORROW INTRADAY

下面的图是我对今后走法的猜测,这可能是个2 legged down,幅度应该大于前三次,因此明天多半会有lower low,算是完成1st leg,然后反弹,这个反弹可能不再会有new high(图中只是示意方向,不确定幅度),然后再下来完成2nd leg。如果反弹有new high的话,只要不是decisively higher,则还是3 Push Up,2 leg down顺延,到时候我们再说。

下面论证一下上面的推测依据。

为什么会有lower low?

- 上面的图已经说明了最主要的理由:Pullback 1 < Pullback 2 < Pullback 3,根据上涨过程中随着买盘的不断消耗,pullback会越来越大的原理(kind of Cobra law),Pullback 4应该大于Pullback 3,所以多半还没有跌完。

- 今天是Major Distribution Day,75%的机会明天会有lower low,这是惯性定律,Major Distribution Day表示卖压大,因此很少一天就跌完的。

为什么反弹上去多半还会掉下来?

- 3 Push Up pattern,因此应该2 leg down。这个不解释了。我现在越来越多的引入pattern的分析,过去我是尽量避免的,因为经验成份比较多。

- 散户太牛了,Rydex traders买了很多牛fund,比2009年7月份还牛。2009年7月以后是震荡向上,我的问题是,凭什么理由我们这次是直线向上?

- 今天的pullback幅度不够,T2122还是很extreme,所以如果有个比较大的反弹,这东东又会overbought。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Thanks Cobra.

start my home work now.

thx,ding

thx,ding

thx, ding

thank you sir!

Thanks Cobra.

this cobra . 100 pts. Awsome market outlook. I did not quite understand the last chart. “The pullback may no be enough today because T2122 still is very close to an extreme level so a little bit large rebound would make it overbought again.”

can you put it other words… sorry i did not get it this time.

T2122 still is overbought, so huge up again would make it go extreme again.

got it

! thanks ! i love the tweets

i love tits too!

Thanks for the report Cobra. Something to think of, one week from tomorrow is FOMC day and then two days later is NFP report, when making your evil plans for market chart. Next week will be very interesting, all coming after European reactions for the rest of this week.

sorry i meant tweets! Go Bills!!!

thanks!

unless spy down below 122, looks still bullish.

THX!!!

The monthly BB13/1 can be quite useful to orient oneself. Chart shows that 1200/1190 is crucial support. Interesting that P&F (not shown here) signals exactly the same message. So the short term question is: what breaks first, 1190 or 1257? I’m in the bullish camp for now, eyeing resistance up at 1280ish (MA9 on the monthly, not shown here).

A very different indicator for the medium term, pointing up to 1285…

Cobra,

Tom Demark agrees with you. He read your posts..

http://www.businessweek.com/news/2011-10-25/demark-says-s-p-500-may-trap-bulls-after-rallying-above-1-254.html

Thanks, I thought he mentioned my name. 🙂

thanks cobra laoda

October 26th is the SIXTH consecutive time that the SPX closed higher after a down day in the month of October. The bulls are in control, SPX 1200 will hold for the month of October and this will be a very bullish month for the SPX.