SHORT-TERM: IN WAIT AND SEE MODE

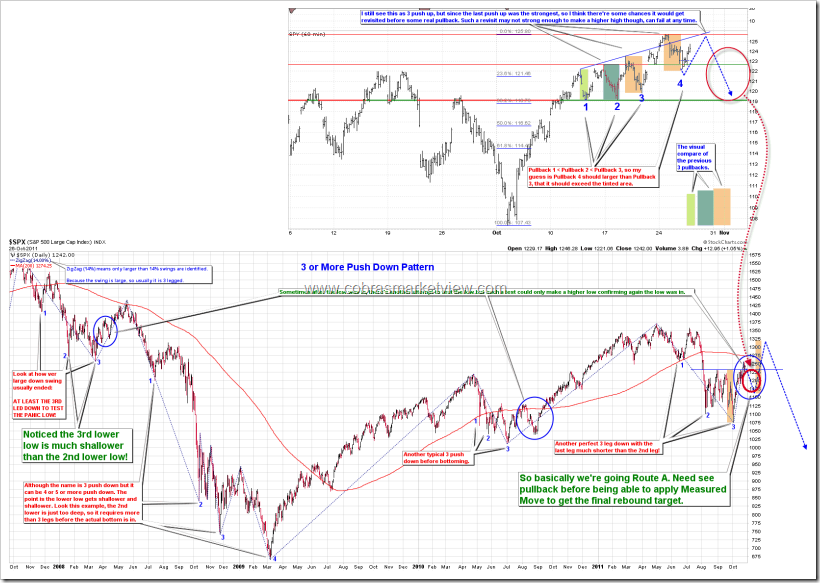

No new stuff, everything goes as planed (insert evil laugh here…), so still the same chart as that of yesterday. Just in order to make sure you guys understand the forecast is totally different on different time frame, so I combine the short-term evil plan and intermediate-term evil plan together on the same chart below. Should be clear enough now, right?

- As long as there’s no decisive new high then maintain the plan, a short-term top should be around the corner.

- Up huge tomorrow to make a decisive new high then most likely would fall back the day after tomorrow, so if indeed huge up tomorrow, it’s bear’s chance (again for aggressive traders only). What I’m really worried now is the market might not give bears such a chance tomorrow. (Again, insert evil laugh here…)

- Although the Pullback 4 was no larger than that of the Pullback 3 as I expected yesterday, they’re almost equal, so should count as a successful speculation. This is important, as it’s a very basic condition to allow me to maintain the evil plan.

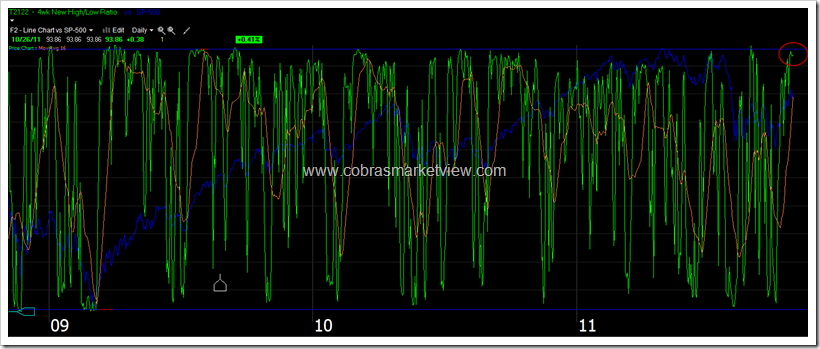

Why is it bear’s chance if up huge tomorrow? Because both NYMO and T2122 are very close to extreme again, so a huge up indeed, more likely I’d yell overbought again. And now you all know what would happen if I yell overbought.

Why am I afraid that market might not give bears chances tomorrow?

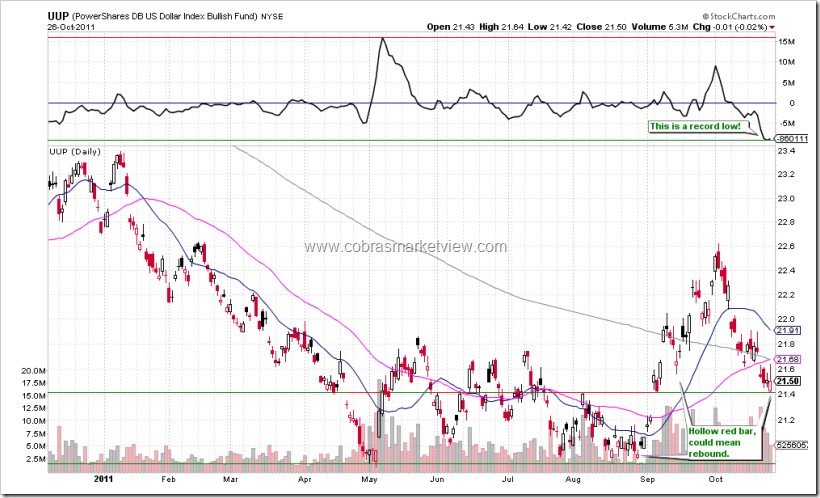

- Hollow red bar plus historically low ChiOsc, UUP might rebound which would put great pressure on the stock market.

- DAX, resistance + 2 reversal bars + 3 Push Up, could pullback too, which if indeed, would mean a gap down open tomorrow on the US stock market. Such a gap down would greatly lower the chances of NYMO making extremes.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: IN WAIT AND SEE MODE

没有新内容,一切都是按计划在走,所以还是昨天的图。为了再次强调不同的time frame是不同的预测,所以我把表示短期方向和中期方向的图放在一起了,现在应该很清楚了吧?

- 下面只要没有decisive new high,则维持计划不变,短期顶部就在附近。

- 既使明天大涨特涨making decisive new high,多半后天又会跌回来,所以是熊熊的机会(again for aggressive traders only),我的担心是,就怕明天不给熊熊机会了,嘿嘿。

- Pullback 4虽然没有按我昨天预期的大于Pullback 3,但是基本等于,因此应该算我推测正确,pullback是越来越强了,这个很重要,基于这一点,所以我还是维持计划不变。

为什么明天大涨特涨是熊熊的机会?因为NYMO and T2122又非常接近extreme了,明天大涨特涨的话,估计晚上我又要说overbought了。

为什么就怕明天不给熊熊机会?

- UUP空心红棒棒加在历史新低的ChiOsc,因此可能要反弹。这个东东反弹,股市不会好。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

thank you very much.

why the P-bar disappeared ?

Any thought?

Disappear means it’s indeed a wrong data so it won’t work anymore if I remember correctly. Not sure.

thanks a lot.

Cobra:

I like your route A approach. However, if huge gap down tomorrow, chances of route A meeting target would still be same as if it were to gap up?

The same. The bottom line: no market can go up forever.

Forever? No. But March 2009 to April 2011 was forever for a lot of bears and its still forever…that is that they will forever not trade again! zing! BAM!

There’s differences between knowing the path and walking the path. Everyone knows there’s no forever up market, the problem is how you make this to your advantage. If it’s that simple everyone would be very rich, the reality is far not true.

thank you, Master Cobra.

Cobra,

I don’t understand. $UUP up tomorrow would help the bears, pulling the markets down.. no? you make it sound the other way.

Laura answered you above.

ricster I think he means you won’t get a chance to short if you are not short already. I suspect huge gap down tomorrow. Gravestone doji on spx.

I don’t think so Laura Croft! We go to 1260-75 area first before we pullback significantly. I’ll give myself a ‘Like’ for my through market analysis! BAM!

looks like HUGE gap up tomorrow which will wipe me out.

EURUSD up BIG at the moment on the greek debt haircut news

i wouldn’t spend too much time trying to analyze the open. i’m in your boat ricster, i’m hugely short – but i also know that what matters is what direction the market takes after 10/10:30am EST tomorrow, and subsequently the day after. what happens overnight in a 4am announcement about a deal being released is just noise at this point. the great part about it for us who are short is that we have all night for the markets to get all the facts, digest it, and potentially sell on the news. so take a deep breath, and let us (bears) see how the markets react tomorrow.

It is only 10:00 and futures are thinly traded…

EURUSD is not. its breaking out…

ricster(little bear ?). no worry. futures just slightly green at this time. no market can go up forever.

Thanks Cobra.

time to my homework.

I hope all of this is just noise because looking at ES futures up more than 1% is tongue biting 🙂

I also hope that tomorrow markets should go to sell mode on the news.

Cobra Laoda, can you remind us why the current circle in your intermediate-term evil plan is similar to Apr 2008, rather than Sept 2010? I know you must have explained it earlier, but I’m very new to your analysis and just followed you from hutong to here. THanks a lot.

too many reasons.

2010 was above MA200. We are not.

2010 was 3 overlapping pullbacks. We clearly had 3 impulse wave down without overlapping. If you don’t understand overlap, google it, probably google the basic wave rule, you might see what overlap is.

What made me worried today most is that XLY:XLP is down huge (did not dig deeper to see if it is because of a heavily weighted stock), which does not bode well with an 1% up market. Having said that, VIX looks like it is inclined to break 30 mark this time around and breadth also looks fine. Mixed signals, so maybe Cobra put it best : In wait and see mode

Thx

So one last thought tonight. Who owns all of this debt that is going to need a massive haircut? My thoughts are logically it is mainly banks and governments. Who has the weakest balance sheets? Banks and governments. If the market does indeed gap up huge it may not be able to hold for the entire day. Add shorts only when the signals are there. I am sitting easy tonight fully hedged (effectively in Cobra mode). I will remove hedges when direction becomes clear. An intraday reversal would be a big sign if it occurs that Wave B is ready to start. If no quick reversal the uber bullish scenario must be considered.

Well, trading is easy (if don’t need consider exit I mean), just follow, no guess work. So if from tomorrow on, the market goes up forever, then fine, so be it, I’d happily buy my dream yacht and retire earlier. 🙂

jarbo456 and ricster,

I trade only futures, and I am not short and I don’t want to give you a hope but based on my experience, ES and EUR most of the time after US market close in Wednsday they go up slowly until before US market in Thursday then they selloff .. I saw this pattern for years ( you can check this, if buy at US close and sell at Europe open you can see the result but I don’t recommend to use it but I mean you will see the same pattern for years ) specially if that Thursday will have an important news or report ( I think tommorow is GDP or something, I don’t follow news ), they take ES to hit any extream high near by, because it is cheaper to do that for the dealers and because traders will be afraid to short at new high while there is a news at that day and bulls will add on any pullback after hitting that extream short term high, so the procces is win win for the dealers.

I just wanted to share this… good luck

agreed dow, and i do enjoy your mild commentary and good set of charts. the buy at the US close and sell at the Euro open was, since i was a junior on an fx desk in early 2000’s was a decent trade. obviously, it got MORE decent over the past 6-7 years that the euro flew…but in any case, what i was trying to explain, which you have said in different terms is that it’s not important where the eur/usd is right now. the most liquid, and thus more valid market direction for the eur/usd trade is the few hours surrounding the US open, and before the euro equity market close.

Cobra, all your bearish arguments are based on counter-trend TA indicators. They often fail during strong trending markets. What I’m seeing is a replay of October 1998.

Was I mostly right recently? I said up then it’s up, I said down then it’s down, still you think the indicators don’t work?

Cobra you have been spot on. I am certain you have made money all the way up on this trend and held longer than most. Hey what thrust above recent high would cancel the evil plan? Also does global es count?

How high is decisive high is hard to say now. I usually draw a line on the 3 push top, if overshot the line too much and hold then chances are this market would never fall. 🙂

Global ES is similar, so no chart for it now as to bring out the ES chart is not easy, I have to start 2 applications and bunch of security code that I have to look from a security card, blah blah blah… 🙂

Besides, you want me to say the trend is up everyday, sure, I’d say that. Would you still come to see my report since I’d only have exactly one sentence everyday? Reports and trading are totally different things. I have to guess top, it’s part of the report. In real trading which I actually report everyday, you saw me shorted? Come on, be fair to me? Was I totally wrong recently?

whatca you talkin about Fu! Don’t question the TA genius of Cobra or he will unleash the Tempest on you!

hey, come on, it’s only venom. Only my bigger brother dragon knows how to make tempest. 🙂

totally agree. Cobra is TA genius.

I just compared the April 2008 with the present pattern (Oct 2011). Cobra is absolutely right!

1. both under 200sma (April 2008 even hit the 200sma then nose dive until end of the year)

2. three push-up.

2008 was a year I couldn’t forget.

Thanks Cobra. this comparison let me learn something I never use, even if tomorrow is up, the analysis here is/will be useful to me.

Don’t say that. I could be wrong from time to time. I just want to be fair to me: All I’ve been saying are NYMO and it did work recently, so really it’s not fair just came out and telling me I shouldn’t say that.

THX!!!

https://standardpoor.wordpress…

the roadmap for today, portfolios and wave count,pics,etc.

yesterday’s best performers in the short term high risk portfolio were

gtiv +13.31%, ift +9.82% and spmd +8.57%, most others were slightly

profitable.

click on my name for the link.