SHORT-TERM: IN WAIT AND SEE MODE

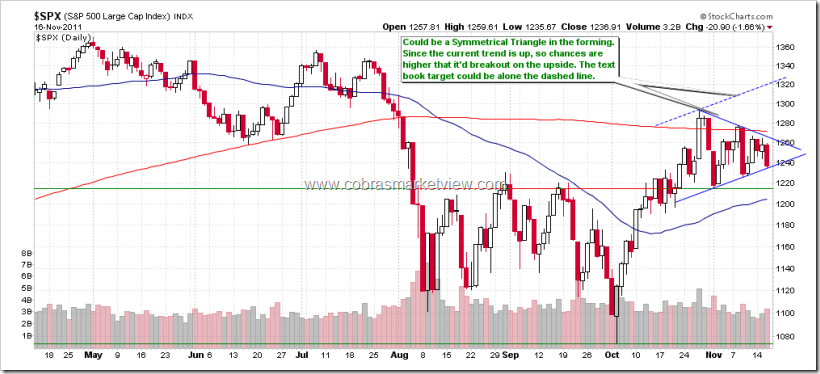

The low today happens to be on the lower edge of the Symmetrical Triangle, the world has been watching, so the direction is still not clear, need see tomorrow, for now the bias is still up though. Even it breaks down tomorrow, before the Nov 1st lows being taken, officially the trend is still up, so bears still have a long way to go.

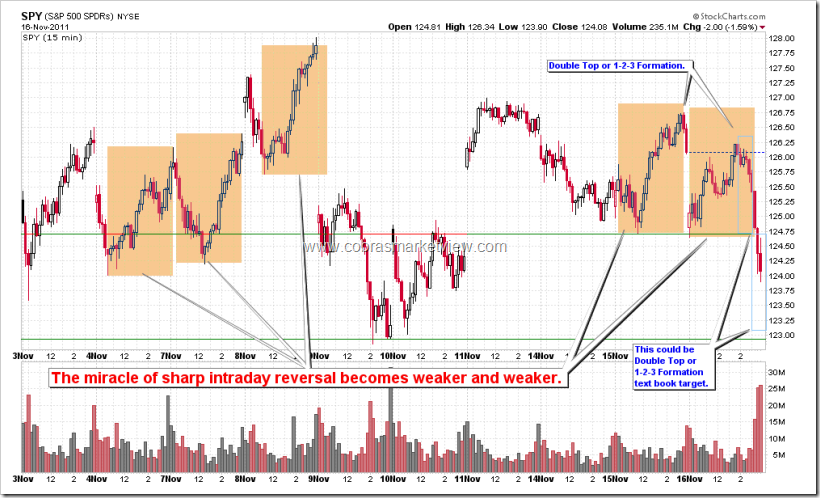

The chart below shows the potential target for tomorrow, assuming no sharp reversal tonight, which, frankly, I’ve got enough lessons (sharp reversals) recently, so dare not to say anything affirmative. Besides the target, there’s one thing I forgot to mention in today’s Trading Signals: In addition to that I don’t believe if down tomorrow we’d see sharp reversal again (like almost always happened recently), I also believe, even, there’s again another intraday reversal, chances are the rebound might be much smaller than the previous few times because apparently the reversals are becoming weaker and weaker with today’s the weakest.

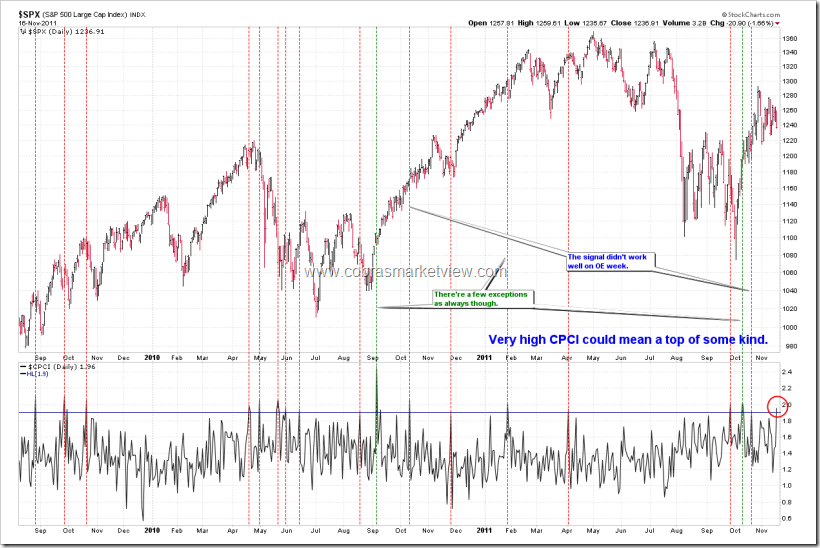

Nothing else to say. The CPCI closed extremely high today which implies that big guys bought lots of put today, therefore usually, it's a sign of at least a short-term top. Just history shows the signal might not work well on OE week, so I’m not sure.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY, WILL NEED REASSESS SPX 1,000 DOWNSIDE TARGET

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details. I’m not sure about this call anymore, will need more evidences to reassess.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: IN WAIT AND SEE MODE

今天收盘正好落在Symmetrical Triangle下沿,因此还是方向不明,需要看明天,暂时bias还是up,既使明天下破了,在11月1号的lows跌破前依然officially trend is up,所以熊熊还有很长一段路要走。

下面的图显示了明天可能的target,假如今天晚上没有sharp reversal的话,老实说,我都给reversal怕了,所以已经不敢断言了。此外,今天的Trading Signals里我忘了提了,除了我不认为明天如果下跌,盘中会有sharp reversal(象最近总是发生的一样)以外,既使有,可能这个reversal的幅度也不会像前几次那么大了,因为今天的intraday reversal明显是最弱的一次。

其他没有什么好说的,CPCI今天很高,表示大户买了很多put,因此往往是至少短期顶的特征,不过这个信号在OE Week不怎么工作,所以我不确定。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY, WILL NEED REASSESS SPX 1,000 DOWNSIDE TARGET

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details. I’m not sure about this call anymore, will need more evidences to reassess.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

just a quick update on the EUR/USD as there seems to be plenty of late session movement in the pair today again. it looks to have put in a small double bottom…though not very deep. so the textbook target would be somewhere around 1.3475. the movement up has been surprisingly strong though, so it will more than likely restest the above trendline.

it’s way too early to predict what affect this will have on the US open.

Right, it is a double bottom.

First attempt at uploading charts here.

EUR/USD seems to have a double bottom in the 30min chart as well?

However, /ES 30 min seems to be very different, though up nicely.

A lot can happen between now and the morning open, but I’m expecting a gap up as of now.

Any opinions? still trying to learn.

Thanks, and sorry, just saw your comment. Nowadays it’s tough to trade this market.

Fund managers and bargain hunters will buy this dip since it is touching the lower edge of the pennant. I’m a little bull bias for tomorrow and believe there will be a gap up on tomorrow open.

Thank you so much!

thx,ding

Thanks.

Recently busy. not watering a while.

BPNYA -0.64%, BPCOMPQ +0.67%, BPOEX -2.56%, BPNDX -1.52%, BPSPX -1.09% and BPINDU flat. Small caps stronger than big caps, BPINDU being the exception (but let’s disregard that one).

Both BPNYA charts convey the same message: BPNYA is showing strength, but is kind of clueless as to its next step (and so am I).

I’ve been playing around with these kind of fuzzy charts lately: The 60 min suggests that support 1230 is going to hold Thursday and that the next biggish move (out of the consolidation triangle) is due next week – system does not indicate direction of next week’s outbreak.

This news is not momentous, but intraday trader likes to know where support is (Wednesday afterhours ES went down to 1228/1230, now very early Thursday morning it’s back up to 1237).

If 1230ish is broken at opening on Thursday support did not hold, period. At 7.25 am ES down to 1222…

Is that a Jackson Pollack painting? 🙂

No, unfortunately not. I’m less talented than Pollack, nor do I live near Maidstone in East Hampton. But if you’re really interested in TA and want to make money in the market – have a second look. If you understand TA and trade wisely you can buy a Pollack in a few years – or a Rothko.

Jackson Pollack’s performance on Thursday was superb, it was only my interpretation of the chart that proved to be wrong. I did not expect the big triangle to break to the downside, could’nt believe my eyes when SPX did not rebound after the break, I didn’t even get a bear-trap. But the Jackson Pollack chart – its performance was flawless…