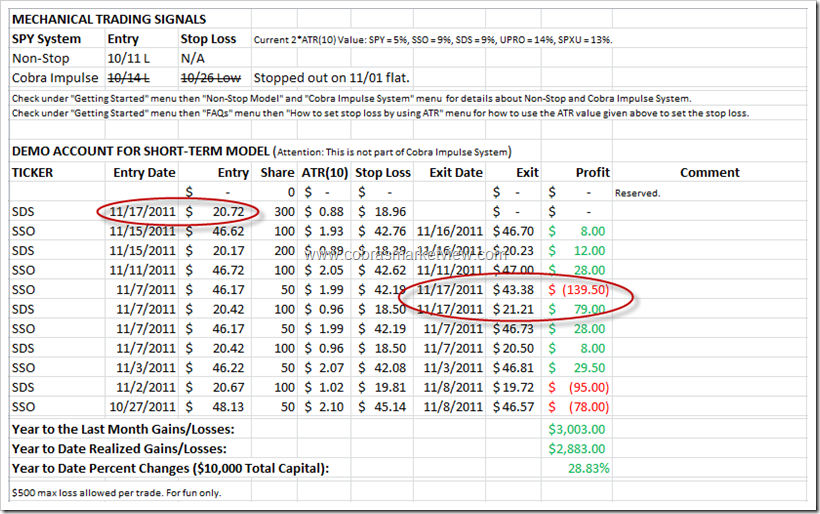

THE SHORT-TERM MODEL BELIEVES THE TREND IS DOWN, HODING SHORT POSITION OVERNIGHT

The bottom line, chances are today’s low is not the low but officially the intermediate-term trend is still up. I’ll provide more details in tonight’s report.

A little bullish biased toward tomorrow for 2 reasons:

- According to Stock Trader’s Almanac, November expiration, Dow up 6 of last 8. (You can always find this kind info from Trader’s Calendar at the top right corner of the home page.)

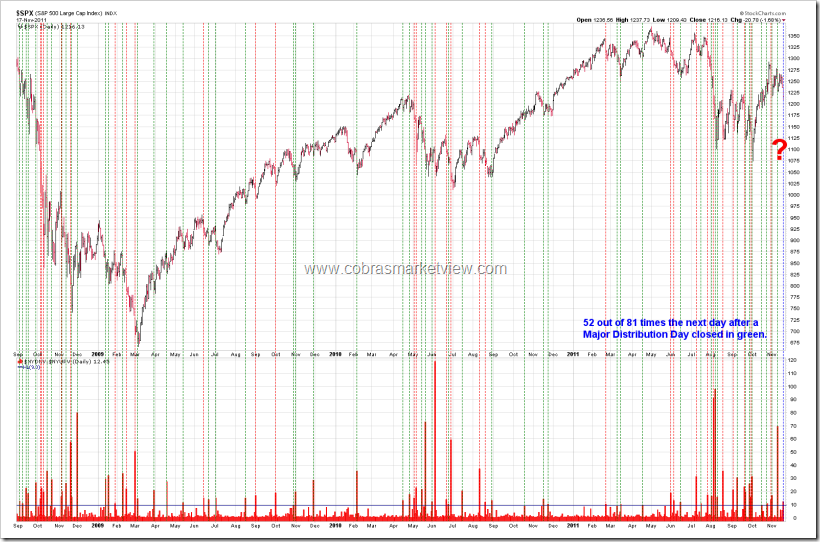

- The next day after a Major Distribution Day had 64% chances to close in green.

thx,, ding

ASTRO Update Decli Speed…

Your words does not make any sense

Have you seen the post…

Your post consists of 4 words. You need to include what you want to say in that post.

I have a rule never to visit a spammers website, so I need to see it on cobras site

That’s a good rule. I like it. I’m going to start using that rule too. Thumbs up.

ASTRO Update Moon Cycle…

any thoughts on why vix has not really shot up the last 2 days? Cobra any stats on that, since SPX down over 4% from tues. high . TIA

Two initial observations to share and ask for your comments and ideas.

1) Nice covering into the close. Large cap was bought more aggressively than small cap on the close. Looks like there wasn’t too much worry about holding short the small caps overnight.

2) The financials lost all their “relative strength” in late session and turned into the relative “dogs” into the last half of the day. Slightly abandoned?

And one Tin Foil item: I think something happened today, something that some powerful people know about and that we won’t know until the first of next week. It was most striking to see the EUR/USD basically sit still (by comparison) while just about everything else got pummeled. (And it could also just have been a good old fashioned technical breakdown . . . but since I’m so conspirisy theory conditioned by everyone constantly telling us that TA is broken, I find that hard to believe even if I do. :-o)

People already know. Fed increased FX swaplines with an 84 day duration.

One of the rumors that I heard on CNBC (take it for what it is worth) is that the super committee has not made much progress, and some (the big boys?) probably wanted to avoid “risk” in case another stand-off happens. We all know what happened last time over the debt ceiling debate.

Or this could be just an opex shenanigan. Key will be what happens next week.

Let’s remember the bounce can be sharp if we have good news/rumor- like the bounce after last wednesday’s bloodbath.

Tiger formation, extremely rare, suggests that tigers will pounce on either bulls or bears.

ha ha, you’re funny!

Three gap down in a row (open less than min of prev close,open), today’s close less than open, buy at close, since 2006:

– all (10) but one hit 1% profit target in the next 4 days

– waiting for the first close above ema(10) resulted one large loss (4.8%) one small loss(0.2%) and 8 wins (average 2.45%)

Not sure about tomorrow, because it’s an expiry date. But note that Bullish Percentages were very weak at Thursday’s close: BPNYA down 5.11%, BPCOMPQ down 2.02%, BPNDX down 10.77%, BPSPX down 9.12%, BPOEX down 9.21%, BPINDU down 8.33%.

http://www.bespokeinvest.com/thinkbig/2011/11/17/down-15-two-days-in-a-row.html

Today marks the 31st time in the last ten years that the S&P 500 has been down 1.5% or more for two days in a row. In the table below we highlight each of those occurrences along with the index’s performance on the third trading day. As shown, of the 30 prior occurrences, the S&P 500 has risen an average of 1.3% following these two day losing streaks with positive returns 22 ties (73.3%).

Perhaps rarer still than uempel’s Tiger pattern below is a possible Salivating Cub developing on the NDX four-hour chart. The “sell” signal triggers when the baby bear begins to drool.

http://99ercharts.blogspot.com/2011/11/ndx_17.html

Have a good one.

50 day MA will hold for a bounce then maybe we get more leg down and the correction will be over.