THE SHORT-TERM MODEL BELIEVES THE TREND IS DOWN, HOLDING SHORT POSITION OVERNIGHT

First of all, don’t forget we’ll have no Market Outlook tonight. And for all my American neighbors, enjoy your turkey!

The bottom line, I don’t see any bottom sign yet, but the market is oversold now, so I won’t be aggressive on the bear side as well. Chances are, we’ll see a lower low and a rebound. The question is when? My story is, well, it’s kind of history repeats itself story, so nothing fancy here: Tomorrow (I shall say tonight), the whole world paniced because the leader – the US stock market is closed, so the world simply runs around like flies with no head. Then on Friday the US market tanks with the whole world with a gap down open but then reverses up to perhaps close in green as we’ve been seeing this kind of drama for many many times. Well, let’s see. My crystal ball is usually right but when everyone of you want to believe it, it’s time to go wrong. So ask yourself, whether you want to believe this drama or not?

I don’t see much edge for Friday when SPY down 6 days in a row, from the win/loss ratio, it seems the rebound could be very huge though. Just chances are such a rebound more likely is a sell opportunity as argued by the TICK chart below. So as I’ve been saying, if you’re not smart and experienced enough, try your best not to front run the market…

Okay, here’s my two cents: the odds are high that the selling is either done, or we’re going to see a crash. (Charts listed in order of appearance in the images below – the links are inverse – just another of those “crazy” Disqus things.)

Remember the cycle study I did a while back (1st chart)? I’ve updated the short term (2nd chart). Supposedly we’re coming into a double cycle low within a larger up trending cycle environment.

Remember the McClellan study I did back in October? Here’s an update I posted last weekend (3rd chart). The buy spike is getting pretty scary, wouldn’t you say? If we go to a lower momentum extreme, then the buy spike would be nonexistent.

The last chart is a rudimentary TICK study I did one day with Cobra’s 3dma (last chart). You do your own work on this one. Note the pre-March 2009 period, and also take close note of the fact that most of the time the extreme low readings come close to price lows (the late July extreme being an exception of special interest).

I’m eagerly looking forward to seeing what you all have much to add, as I am well aware that this is but a drop in the bucket. TIA

http://img4.imageshack.us/img4/9931/cobratick101011.png

http://mediacdn.disqus.com/uploads/mediaembed/images/167/5488/original.jpg

http://img210.imageshack.us/img210/3231/spxcycle231111.jpg

http://img689.imageshack.us/img689/9653/spxitcycle081111.jpg

Thanks Cobra.

No market outlook for euro readers? We dont have turkey 🙁

I’ll see what I can do. The first priority is to move to the new site as I’m not sure when I can finish the moving so that’s why I cannot promise anything here. Sorry about that.

Thank you!

I’m really sorry, haven’t been slept well for about a week, can barely move now, so sorry. 🙁 Still it’s the same, I don’t see any bottom sign but bears are equally dangerous now.

thanks man.

Happy Thanksgiving Cobra!!! Eat some Canadian turkey 4 me =]

Hey Cobra/All,

Hope all of you are doing good and happy TG in advance. 🙂

This is what i stated when SPX was trading @ 1285

http://www.cobrasmarketview.com/2011/10282011-market-outlook-still-overbought/#comment-350318910

I have found out that what i predicted through my analysis has more than proven right. I stated we will bottom around 1050-1060 on the ES and we touched 1068. I stated that after this point we will rally hard all the way on TF to 750 and so it did.

So, here’s my magic wand work once again.- Next 2 weeks will be range bound- By either OPEX of november or towards the end of Nov, TF will wipe out all the gains it made through this rally- We will however end this year with TF regaining back again all of what it lost in Nov, the so called santa rally.- January will bring bears out of oblivion. TF will lose 50% by end of january.

1 – Check

2 – We are getting there.

3/4. Lets see how it pans out.

As is always the case with me, yes cobra i am still human (earth people) and a very weak hearted human. 🙁 I got out of my shorts prematurely on my high-risk trade while keeping my Core shorts intact and will hold until we get closer to 2.

Most likely the next 2-4 trading days will be flat-to-up. And then we will have one massive downside move that will take us to 2) above. I will have to wait and see what would come next though. I still feel my story of 3/4 is still valid unless something changes.

But yes, each day is a new learning experience here man with so many varied folks joining/commenting on your EOD and intraday threads. It is amazing. I am happy for you cobra for the way you have worked hard all these years and i guess the quality of folks that are contributing out here speaks volumes of your work itself.

Thanks for being there for all of us. 🙂 Enjoy your weekend guys.

GLTA

from the number of likes to your post seems there are alot of bears out there! 🙂 Please do check back end of January so that we can assess (make fun) the success of your predictions! 🙂 Good Luck!

hi cobra,

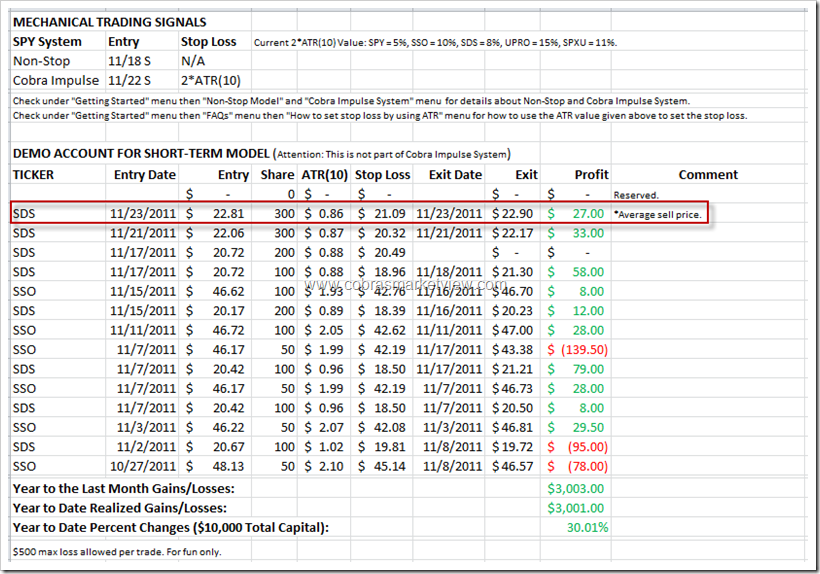

your sds position from 11/21 is nicely in the money. should not we move the stop loss now? or we just let it stay like it is?

You should at least make a breakeven stop loss, then perhaps half out. The rest I will hold until the very first long setup triggered.

Looks like a major bottom is near. Oct lows being broken shouldn’t shake any strong handed bull. On about 5 different metrics the stock market is at a level of hate that has never been seen before in history, explaining why the violent Oct 2011 rally was historical in nature. I don’t think that’s how tops are made. Usually that’s how bottoms are made, so I expect to see more historic rallies ahead.

Interesting seasonality. In the past 4 years every November (end of October in 2009) had similar NYMO spike down . None of them follow through to the downside but rallied into the year end.

Working on 3rd 90% Dn Volume day in last week. Similar clusters seen 10/3/11, 8/8/11, 10/9/08. $SPX +9% +8%, +4% 1wk ltr

http://twitter.com/#!/MarketTells/status/139383431338524672

The low the last 4 years has always been on the Monday after Thanksgiving in the SPY! But even in those years, we had at least ONE up day during days leading up to Thanksgiving. – this has been truly EXTREME!

http://www.schaeffersresearch.com/commentary/observations.aspx?ID=108892&obspage=2

http://www.bespokeinvest.com/thinkbig/2011/11/23/worst-thanksgiving-week-ever.html

We also should have bottomed yesterday at the latest due to the opex effects, so something very powerful is going on to overwhelm the usually reliable

-D

ES futures up 7.50 here. Frustrating if we gap up Friday. This market only rewards brass balls.

I hope you guys have been following me because its just foolish not too. I told you folks we are either going to 1205 or to 1160 before we head back to 1205. So guess what..we are at 1160 and we are going to go back to 1205 now.

A big buckeye booyaaaa Cramer!!!

Internet is full of bigmouth quirks, suggest you back up your assertion with TA rationale (P&F charts might help you…)

uempel giving price levels is my TA rationale. If you are looking for chart with a bunch of lines and indicators and all that BS no way not this awesome guy! And trust me i know about PnF charting then you think. I see you post the Bullish Percentages all the time. all you need to know is the 70% and 30% level or the 6% move rule otherwise you overthinking it. Remember Charles Dow was a country bumpkin you think he gave it all that much thought! LOL…and yes i’m awesome!

Nobody is arguing that 1150/1170 ain’t full of support levels. But I try to assess their importance for Friday, end of November 2011. And as literally all BPs look weak-kneed I don’t want to go long here. But TA and trading ain’t a religion, it’s about making money end of month/end of year. Right now I see much better odds further ahead… I might be wrong, but I prefer not to make money than to lose money. As to your trading: I guess you are loaded up with ES longs and I hope you make tons…

Go Bucks!!!!!!

I agree – It’s rally time. (although we may see 1150 first)

O-H-I-O

Cobra, congrats for successful migration to your new server!

As to the bullish percentages, they are down heavily Wednesday: BPCOMPQ down 7,32%, BPNDX down 5.88%, BPOEX down 12.07%, BPSPX down 9.29%, BPNYA down 10.87%, BPSPX down 9.29%.

Chart shows that BPSPX in support zone – but I can’t load the chart. Click on “Image” does not work…

Ahh, now it works:

Nice charts…looks like a drawing on my fridge that my 5 year old niece scribbled for me. LOL…come on… really???…over thinking again.

Yeah, chart is really messy, but you’ve got to focus solely on the ellipses They show that a good spot for a bounce would have been about a week ago at 55, support now at 50.8 ain’t convincing. Shows that there might be a minor bounce, but chances are very 50/50.

If I add this informaiton to what the P&Fs and other charts tell me I don’t like the odds for going long Friday. Of course I might miss a bounce but I’m in this business to make money and I try to avoid 50/50 risks.

It’s Friday morning 2 am, Asian markets are down and ES is at 1155.

Nigapls is feasting on Turkey, so I’ll jump in: traditional P&F suggests a bounce or at least a close above 1160 on Friday. A close below would be very bearish.

The NYA Volume profile looks like a buy spike, as does the cpc.

If we blow out down through support, I’ll be batting down the hatches.

http://mediacdn.disqus.com/uploads/mediaembed/images/169/3703/original.jpg

test

Thank you, finally figured out how to login this page.

Cobra, you indicated in an earlier post that “contribute button” would be available when sever changed. Still don’t find. Know you are real busy and sleepy from your posts — please sleep — tell wife President to knock you out with iron skillet, then you sleep well but only have knot on martian knoggin — you martians can think better with knot on knoggin unless you like earth people and try 2-3 times with 2-3 knots on knoggin — maybe get it the first time.

Also, this poster “umpel”, please consider “contribute button” for him too 🙂

Thank You for this site & thank you for your very hard work!

Thanks. I have one final adjustment on the server side before going to bed. Hopefully won’t need wait until mid night AGAIN.

The “donation” page is here: http://www.cobrasmarketview.com/membership-options-page/, I just offer another choices for locking the future rate now, so both side (you and me) benefit from it. I’ll announce this link as early as this weekend.

Thanks again. Have a good night.

Cobra/Others,

Need some help here.

I am new to freestockcharts.com. How do i overlay another price chart with relative values? If i am looking @ SPY and then i want to do a comparison with say SIRI (as an extreme example), it doesn’t show relative values and instead a single line.

Any thoughts? I know you guys have been using it for way longer than i am. 🙂

Thanks in advance.

Jason

Click Settings then select Comparisons. Then you’ll see attached. The comparison chart can only be line chart. Not much choices like you could do with stockcharts.com.

Thanks cobra for taking time out of your already bz sched. Much appreciated. What i was looking for was

http://lh4.ggpht.com/-fhZqGRkDlXw/ThO0leZrCmI/AAAAAAAALC4/QWSEAIG0Lh4/s1600-h/T2122%25255B2%25255D.png

I was able to get to what you posted, but was unable to get what you got in the above chart using the same setting tab/options.

Thanks again.

That chart was from Telechart, not freestockcharts.com, although it’s from the same company.

Oh ok. Much appreciated.

Have a good weekend and get some rest cobra. 🙂

USD Wedges

http://mediacdn.disqus.com/uploads/mediaembed/images/169/6574/original.jpg